How Will the EU’s New GHG Emissions Import Tax Affect the P&P Industry?

This content is being republished with the consent of Fisher International and ResourceWise. Read more about EU’s New Tax on Imports Based on GHG Emissions at ResourceWise. Dec 28’22

Goods with a carbon intensity greater than the EU’s emissions criteria will be taxed at a rate decided by the EU Emissions Trading System (ETS), with the border adjustment offset by carbon emissions taxes in the exporter’s home country.

This article aims to explore the impact of the EU’s import tax on the Pulp and Paper (P&P) business and to assess responses from P&P industry participants.

The P&P industry

The pulp and paper (P&P) business are one of the top five industrial sectors regarding greenhouse gas emissions. Paper, tissue, packaging, and other cellulose-based products are among the products manufactured by the industry. With a vast number of people and significant profits, the P&P industry has a significant global impact on the environment and economy.

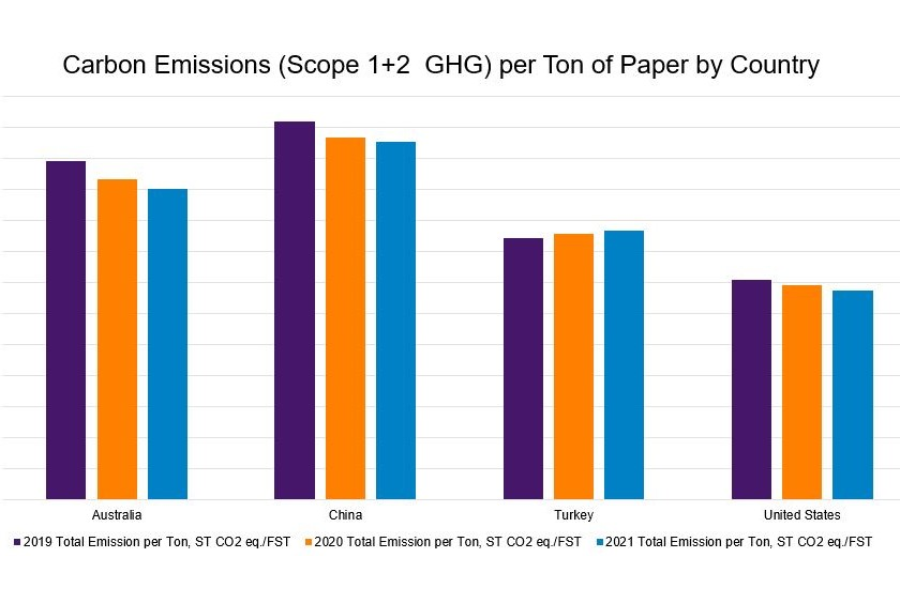

The value of traded global CO2 permits recently climbed by 164% to a record €760 billion, with the EU’s ETS accounting for €683 billion. As the cost of carbon rises, the P&P industry is under growing pressure to cut its carbon emissions.

Impact on the Pulp and Paper Industry

The P&P industry is one of the top five industrial categories contributing to the most greenhouse gasses emitted. As more countries adopt net zero targets, we are beginning to see more announcements and deployments of more carbon pricing programs. These new restrictions will impact the P&P industry, and companies will have to find ways to cut their emissions or pay the carbon price.

The import tax will impact P&P enterprises and their emissions since they would have to pay more for imported goods with a greater carbon intensity. This could affect P&P companies’ output and pricing since they may move to more sustainable products or raise prices to offset the expense of the levy.

P&P industry response to GHG emissions import tax

The Pulp and Paper industry may adopt several strategies to mitigate the effects of the EU’s new GHG emissions import tax. One strategy could be to invest in new technologies and processes that reduce carbon emissions, such as using renewable energy sources and implementing carbon capture and storage systems.

The industry may shift towards producing more sustainable products, such as using sustainable wood sourcing and recycling paper products. Another strategy could be to invest in carbon offset projects, such as reforestation or soil carbon sequestration, to offset the carbon emissions caused by imports.

The potential impact of the industry’s response to the EU’s new GHG emissions import tax on the EU economy and environment is likely positive. By investing in new technologies and processes that reduce carbon emissions, the industry can comply with the tax and improve its overall environmental performance.

Shifting towards more sustainable products can help the EU achieve its net-zero targets. Investing in carbon offset projects can also contribute to the EU’s efforts to reduce greenhouse gas emissions. This can lead to a more sustainable and environmentally friendly P&P industry and positively impact the EU economy and environment.

Comparison to Other Industries

The P&P industry is not the only one affected by the import tax. Other industries affected include steel, aluminum, cement, fertilizer, and electricity. By comparing the P&P industry’s influence on emissions and response to the import tax to other industries, we may better understand the overall impact of the tax on different sectors of the economy.

©[2022] Fisher International (ResourceWise). All rights reserved.

Wrapping Up

The EU’s greenhouse gas emissions import tax is a significant move that will impact the P&P industry. Companies in the P&P industry will have to find solutions to decrease emissions or pay a carbon tax, which could result in production and pricing adjustments.

Some P&P industry players have welcomed the tax as an incentive for sustainability, while others have criticized it as a burden on the industry. It is crucial to highlight that the P&P industry will not be the only one affected by the import tax; other industries will also be impacted.

As the carbon offsets and credits market expands, it will be critical for the P&P industry to adapt and find new methods to compete in this new reality.

Stay in tune with the latest happenings across the industry with Coniferous, leading supplier of kraft paper and major proponents of the carbon neutral model.