How China’s New Tariff Policy Will Impact The Global Paper Industry?

This content is being republished with the consent of Fisher International and ResourceWise. Read more about China’s New Tariff Impact the Global Paper Industry at ResourceWise. Jan 23’23

- The Chinese government implemented an import tariff rate on 1020 items of paper and paperboard, on January 1, 2023,

- China aims to add value to industrial and supply chains by implementing a 0% tariff for finished paper products, printing, containerboard, and writing paper.

- These new tariffs will help the forestry economy in the country and the rest of the world.

The paper industry is one of the most important components of the global economy. However, recent changes in China’s tariff policy have raised concerns about the industry’s future. Starting January 1, 2023, China implemented a provisional import tariff rate for 1,020 commodities, including 67 finished paper products and converting products.

These products will enjoy a lower import tariff of 0-5% compared to the standard MFN import duties of 5-6%. While this policy is aimed at strengthening resource supply capacity and improving the resilience of industrial and supply chains, it will have a significant impact on the global paper industry.

Decreasing Tariffs to a certain level Can Increase Imports and Foreign Exchange Expenditures

From a bigger perspective, reducing tariffs can increase imports and foreign exchange expenditures. It can also reduce foreign exchange reserves, which is dominated by US dollars in China. The current serious inflation situation in the United States economy means that stimulating imports that can avoid China’s foreign exchange reserves will depreciate. As a result, this policy will lead to foreign exchange losses.

Impact on Domestic Manufacturers

The new import tariff policy will impact domestic manufacturers heavily. Due to China’s zero-Covid policy, domestic demand for paper products has decreased, which has directly impacted the paper industry. Lower demand for paper has led to lower operating rates and lower market prices. 2022 saw the lowest point in the linerboard prices in the last two years.

Encouraging the Import of Oversea Production into China

The decreased import tariff will encourage the import of oversea production into China at a lower price and most likely a higher quantity too. This would pressurize the industry. In the short-term, domestic paper prices will continue on a downward trend. Some years down the line, as the net profit reaches a new low, more number of manufacturers will exit this market, and more consolidations will be expected to occur in the upcoming five-six years.

Opportunity for Manufacturers in Emerging Countries

For the mills that will be shut down, an opportunity arises for manufacturers in emerging countries in Africa, the Middle East, and Latin America. These areas have a preference for used equipment imported from China. By obtaining secondhand machinery from factories that may soon close down due to their high-risk status, manufacturers can save a significant amount compared to purchasing new equipment. Meanwhile, local producers may need to strategize on ways to enhance their competitive edge and remain viable in the market.

Increasing Competitive Advantage

Domestic producers should consider whether to stick to mass production by capacity expansion or grow roots and develop within a niche market. They need to increase their competitive advantage to stay in the market. For instance, they can invest in advanced technology paper machines with sound capacity of over 200,000 MT/Y, while the majority are producing capacity greater than 100,000 MT/Y. By adopting advanced technology, they can improve efficiency and reduce costs, which will increase their competitive advantage.

©[2023] Fisher International (ResourceWise). All rights reserved.

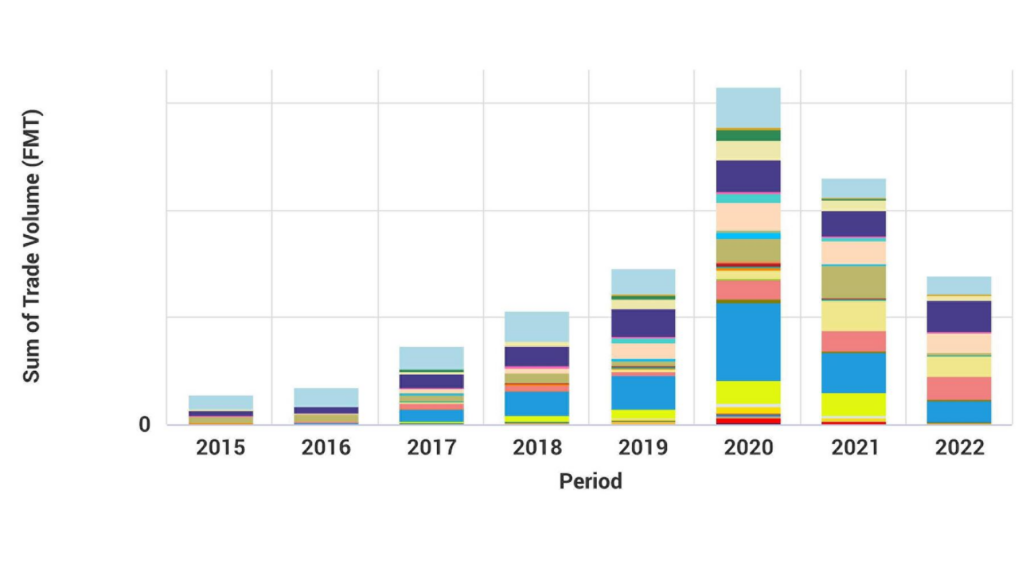

Impact on Imported Containerboard

The volume of imported containerboard has been on rise since the ban of recycled fiber imports. While the volume had reduced in 2021 and 2022, it’s highly anticipated that the travel restrictions that are to be lifted in 2023 will elate consumer confidence and trigger more import opportunities. Market share would be gained by more paper products and brands. This will primarily impact those with stable quantity, adequate supply, and competitive prices.

Preparing for the Changing Market

This new provisional import tariff in China is bound to impact the global paper industry. Management in this value chain will need to be ready for this new dynamic shift and the challenges it could bring forth. In such a volatile industry, it’s crucial to always address questions in advance to anticipate market shifts.

In conclusion, China’s new tariff policy is set to have a significant impact on the global paper industry. While some finished paper products will enjoy a 0% import tariff, this will put pressure on domestic manufacturers in China, who are already grappling with reduced demand and lower market prices. The reduction in tariffs is likely to increase imports and foreign exchange expenditures, which could result in foreign exchange losses for China.

The changing market conditions resulting from the tariff policy mean that companies in the paper industry must take proactive measures to prepare for the potential impact. This includes considering how to increase their competitive advantage, as well as exploring opportunities for emerging manufacturers in other regions. While the situation presents many challenges, it also offers an opportunity for companies to adapt and innovate to stay ahead of the curve in this ever-changing industry.

With global efforts to bolster the industry, stay updated with Coniferous and get to know the ins and outs of this dynamic industry.