From Growth To Pause: Decoding India’s Pulp and Paper Rollercoaster

This content is being republished with the consent of Fisher International and ResourceWise. Read more about Pulp and paper industry in India at ResourceWise. Aug 16’23

India takes center stage in the vibrant realm of the paper industry, proudly holding a spot among the world’s top 5 largest producers in the industry. The figures tell a fascinating tale: an 8% growth waltz spanning from 2018 to 2022, guiding India’s pulp and paper sector through quite the expedition.

Yet, as the plot thickens, a twist unfurls within the past half-year. Tucked away in the western and northern corners of India, kraft paper mills have quietly exited the scene, entangled in the labyrinth of export hurdles and an overabundance of productive prowess.

Exploring the significant shift, we analyze its driving factors. Simultaneously, we gauge the Indian pulp and paper market’s present condition, painting a vivid picture of its state. In this ever-evolving narrative, the question lingers: What awaits on the horizon?

The mastermind behind this plot twist owes its origin to the global hunger for commodities, keenly felt within India’s Asian kin. As the demand melody falters, ripples course through India’s kraft and recycled board domains. Prices, once stalwart, descend as exports for these grades spiral amidst unforeseen demand choreography. This upheaval leaves a string of mills grappling with an unwelcome surplus.

To wrangle control over this tumult, the intrepid leaders of medium- to small-scale kraft mills embark on a daring endeavor. Some bravely designate specific production days each month, aiming to wrest the surplus from the market’s grip and finesse the sway of pricing dynamics—an artful equilibrium play in an industry well-acquainted with strategic dance.

Unmasking Intriguing Trends In India’s Pulp And Paper Arena

Amidst mill closures pirouetting to the tunes of market demand, what other captivating trends are adorning India’s paper industry stage?

Surging OCC Prices: Within the vast confines of India’s domestic market, it emerges as the grand conductor of waste paper imports. This role naturally orchestrates adjustments in waste paper and OCC prices within the nation. Recent weeks (July-August 2023) have unveiled a rising crescendo in OCC spot prices. In a delightful twist, paper mills, undeterred by lower end-product prices, continue to tread the same purchasing path.

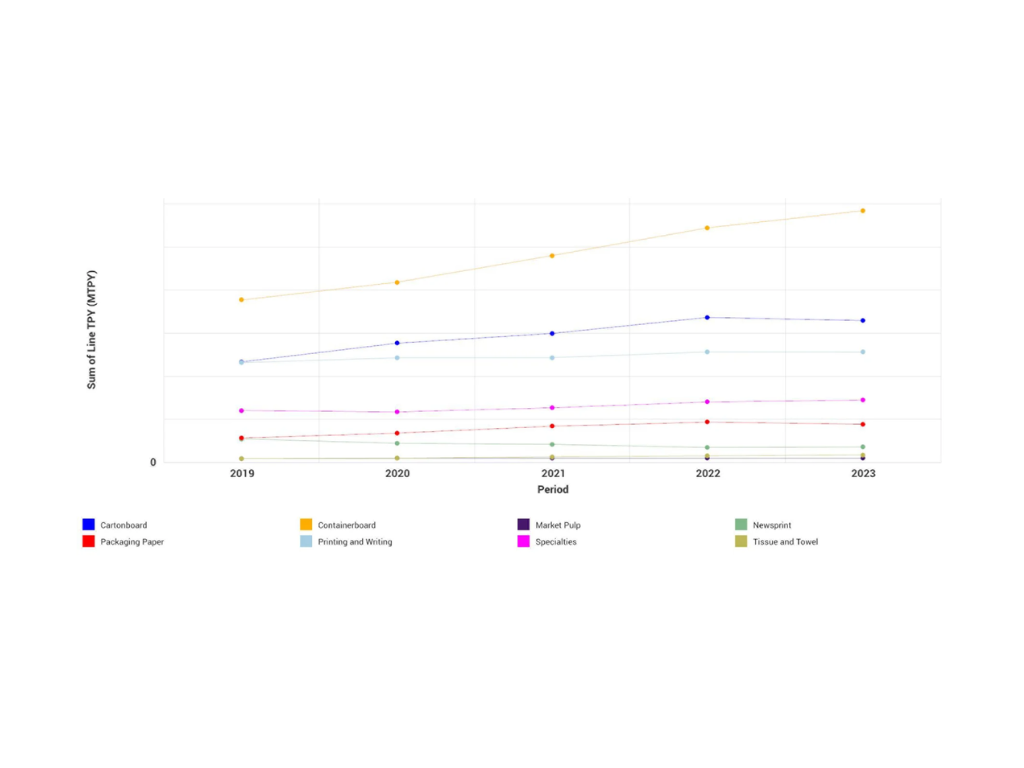

Printing and Writing Sector’s Radiant Prospects: Gaze toward the sunny side, and the writing and printing realm has gracefully held its own in India’s landscape. Behold the masterpiece below—an image painting printing, and writing as India’s third largest grade in production. This virtuoso feat proudly positions the nation as the fifth largest global producer. While not steadfastly clinging to the zenith of capacity production, this sector has even indulged in a slight growth waltz—a phenomenon akin to a rare dance not often witnessed elsewhere.

India’s Pulp and Paper Capacity by Major Grade

©[2023] Fisher International (ResourceWise). All rights reserved.

In the world of integrated writing and printing mills, applause roars for their remarkable feats in both sales volume and profitability. Moreover, the curtain rise on the Indian government’s fresh educational policy is set to bestow further growth upon this realm. A standing ovation is due, especially for the printing of new tomes of textbooks and academic materials.

Epic Investments Unveiled: Whispers are abound regarding grand investment schemes by APP in the Maharashtra region of India. This ambitious venture seeks to birth a production output of 1.2 million tonnes by the fiscal year 2026/2027. As this majestic project looms on the horizon, existing industry stars are carefully fine-tuning their strategies, preparing to shine brightly in the market’s cosmic ballet.

Sustainability’s Spirited Ascent: The Indian mills have donned the robes of eco-consciousness, recognizing the regal stature of paper packaging as the superior sovereign over plastic-based counterparts. Their court is abuzz with strategic enhancements and ventures aligned with these noble sustainability norms. Behold Naini Tissues, hand in hand with Valmet, crafting flexible packaging paper

—a testament to their proactive stance.

Tissue Triumph: A global symphony of tissue expansion resonates at a CAGR of approximately 6.5%. India’s rendition of this tune is no less impressive, marching to a nearly comparable rhythm. A grand spectacle of tissue investments graces the upcoming act, tailored not only for the local crowd but also for overseas admirers. A prime example: the spotlight shines on Gayatri Shakti Paper Mill, as they entrust Toscotec to weave their tissue-making magic with a state-of-the-art machine, echoing the melody of the times.

As India’s paper industry navigates these intriguing shifts, keeping a vigilant eye on emerging trends is paramount. Amidst mill closures and dynamic market adaptations, the journey continues. For a front-row seat to the evolving narrative of India’s pulp and paper domain, make sure to stay updated with Coniferous.