Navigating Turbulent Waters: Preparing for Geopolitical Challenges in Shipping and Finance

Over the last couple of weeks, we are in acute pressure to be able to ship goods. The world is in a very precarious situation. Whilst the global and regional tensions are soaring in the Middle East with the conflict in West Asia, there is conflict brewing between the other countries in the Arabian peninsula. This has led to severe shortage in vessel space and also extremely high freight costs. At Coniferous, we are bound by our commitments and try our best to fight the odds for the benefit of our trusting customers. However, many of our suppliers and agents, including some Shipping Lines, have started sighting force majeure clauses from Friday. But the final blow was received earlier this week.

As some of you might be aware that there was a MSC ship that was apprehended of the coast of UAE as it was crossing the Straight of Hormuz, we would like to throw light on the said issue. (Please refer to the link: https://www.livemint.com/news/world/israeliran-tensions-cargo- ship-seized-17-Indians-on-board-strait-of-hormuz-11713014875534.html)

The tensions in the region can lead to blockage of the Straight amid rising tensions, which can choke the global energy supply, but more so, it affects the shipments to the gulf. The Red Sea issue is far from resolved, as many vessels have started going around the Cape of Good Hope. The average increase in sailing time is as below for shipments originating from India/ Asia:

A.Europe: 17 Days

B.Inter Asia: 9 Days

C.North America: 6 Days

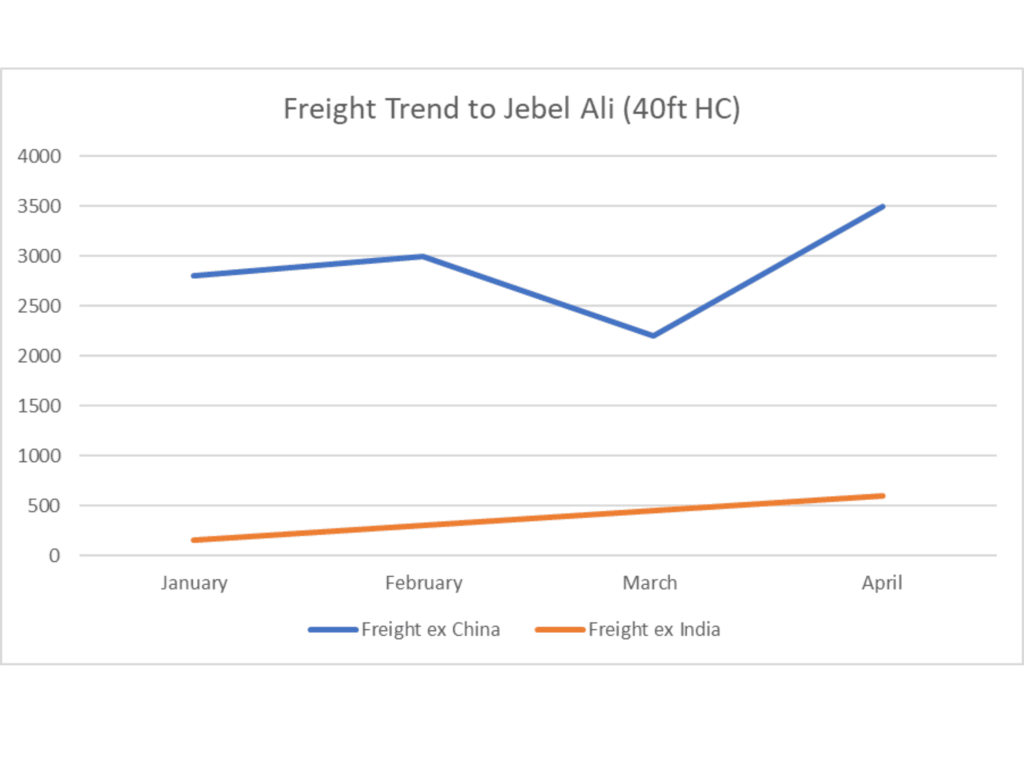

Whilst rates came down towards the end of March owing to weak global demand and lower need of shipments, rates have shot up throughout April. Average rate for Jebel Ali ex-India and ex-China has been showcased below:

Whilst the delta of the increase is different and the freight is very different, but we expect higher surges from both ports in the coming weeks. Also, there is a gross impact on the credit insurance and the shipping insurance borne by the entire supply chain. There is already no shipping insurance available for Red Sea shipments, and very soon many insurance companies might start the same for the greater GCC.

Keeping the same in mind, please be prepared for:

- Delays in shipment

- Higher CIF costs because of the force majeure clause indicated by the lines and our suppliers as well as higher marine insurance costs.

- Our ability to finance would lower as our Credit Insurers are forcing us to move towards more secure payment terms.

- Scarcity of the entire supply chain, as the glut will be felt across the supply chain. Pulp has risen from USD 680 to USD 760 on the above premise, and is expected to stabilize at USD 800 PMT.

On a MacroLevel also, please note:

- Gold is at a historic high and the US bond yields are also at a high. The Fed is expected to cut rates, however, from the last meeting, the Fed has kept rates unchanged.

- Traditionally whilst Gold Rates are high Bond yields are low and vice versa. As when bond yields are high, people invest more in bonds, as the return from gold would be diminishing. This is again an alarming situation as investors are harboring safer options amongst raising worries.

- Lastly expect soaring commodity prices as freight and geopolitical issues would affect almost all major commodities.

These alarming situation is brought forth to your knowledge not in order to scare you, or an excuse for the aforementioned outcomes we are facing, however just as the pandemic that has gone by, it is preparing us to battle the storm. Together with your help and support we can weather this storm and bring about the best for your business!