Paper Dreams: Exploring India’s Pulp and Paper Boom

This content is being republished with the consent of Fisher International and ResourceWise. Read more about Pulp and paper market at ResourceWise. July 15, ‘24

India’s pulp and paper industry is riding a wave of transformation, fueled by economic, demographic, and technological shifts. For industry professionals, understanding these changes is key to seizing new opportunities and overcoming challenges.

Unveiling India’s Pulp and Paper Landscape

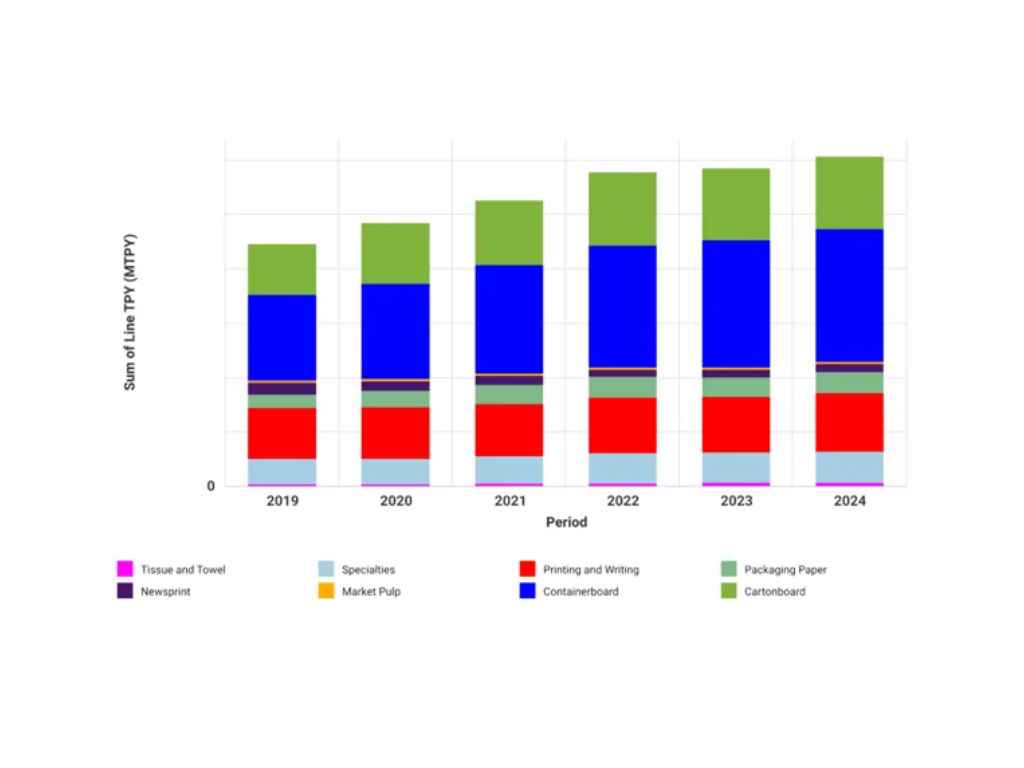

India, with its burgeoning economy growing at a rapid 7.5% GDP rate, is witnessing an escalating demand for various goods and services, including paper products. The country’s paper production capacity has been on a steady rise, with a projected compound annual growth rate (CAGR) of 6.30% in pulp and paper capacity from 2019 to the end of 2024.

The industry is a significant contributor to the Indian economy, providing employment to over 500,000 individuals and accounting for approximately 1.6% of the nation’s GDP.

The Diverse Paper Grades: Where Growth is Happening

In an unusual trend among major producing countries, writing, printing, and copier grades are performing exceptionally well. This steady demand underscores the essential nature of these products in education and business operations.

Rising literacy rates, particularly in rural areas, are driving demand for writing and printing paper. India’s New Education Policy (NEP), implemented in the 2023-2024 academic year, has further boosted this demand. The NEP’s focus on extended schooling, higher education reforms, and universal access to education presents significant opportunities for paper producers to align their strategies and meet evolving market needs.

The tissue paper sector is also experiencing substantial growth. Items like toilet paper, paper napkins, and kitchen towels are becoming household staples, driven by heightened hygiene awareness and rising disposable incomes. Investments in the tissue sector are on the rise.

The journey is not without its hurdles. High raw material costs, particularly for waste paper, imported pulp, and wood chips, pose significant challenges. These rising costs have led to increased prices for final products, particularly fine paper and recycled board, making market acceptance a challenge.

The containerboard sector faces its own set of issues, including surplus capacity, volatile raw material scenarios, and outdated machinery. Adopting advanced machinery is essential for optimizing operations and staying competitive. Despite these challenges, the future of containerboard in India remains promising, with growing domestic market potential.

Soaring container freight rates have further complicated matters, driving up costs and impacting the supply chain. Producers must adopt strategies such as optimizing shipping routes and negotiating better contracts to mitigate these challenges.

High imports of paper and paper products, particularly from China and ASEAN countries, have made domestic production uncompetitive. This surge in imports poses a serious threat to the sustainability of the Indian paper industry.

Opportunities Abound: Embracing Growth and Innovation

Despite the challenges, India’s pulp and paper industry is ripe with opportunities for growth and innovation. The surge in demand for recycled board, driven by economic recovery and growing industrial activities, is a positive sign for the industry.

India’s booming flexible packaging market, fueled by a growing middle-class population and increasing export demands, presents significant opportunities for producers. Innovations in resealable closures and sustainable materials are shaping the future of flexible packaging.

The décor and absorbent kraft grades also hold significant potential, especially with the steady growth of the real estate market. Most of the demand for décor grades is currently met through imports, presenting an opportunity for local producers to capture market share with competitive, high-quality products.

The Road Ahead: A Bright Future with Strategic Moves

The future of India’s pulp and paper industry is bright, with numerous avenues for growth and innovation. Producers must focus on sustainability, efficiency, and quality to unlock these

opportunities and drive the industry forward.

However, addressing high raw material costs, supply chain disruptions, and market fragmentation requires strategic planning, investment, and collaboration. Producers need to remain agile and proactive, anticipating and responding to challenges effectively.

India’s pulp and paper industry stands at the cusp of a promising future, brimming with opportunities for growth and innovation. By embracing new trends, investing in advanced technologies, and focusing on sustainability, industry stakeholders can navigate this dynamic landscape and achieve long-term success. Stay connected with Coniferous for more insights and updates on the latest trends and opportunities in the pulp and paper industry.

#ConiferousInsights #PaperDreams #IndiaRising #IndustryTrends