Navigating the Pulp Seas: Key Price Drivers for 2023 and 2024

Behold! The pulp market has finally lifted its fog of uncertainty, allowing us to bask in the clarity that has emerged after a tumultuous year. Farewell to the logistics constraints and pandemic policies that once burdened us, but let us not forget the rollercoaster ride of pulp prices that kept us on our toes for the past couple of years.

Pulp Inventory Hits the Stratosphere!

Hold onto your hats, pulp enthusiasts, because the chemical market pulp producers have outdone themselves, reaching an all-time high in inventory volumes. It’s a feat that deserves a round of applause, but wait, there’s more!

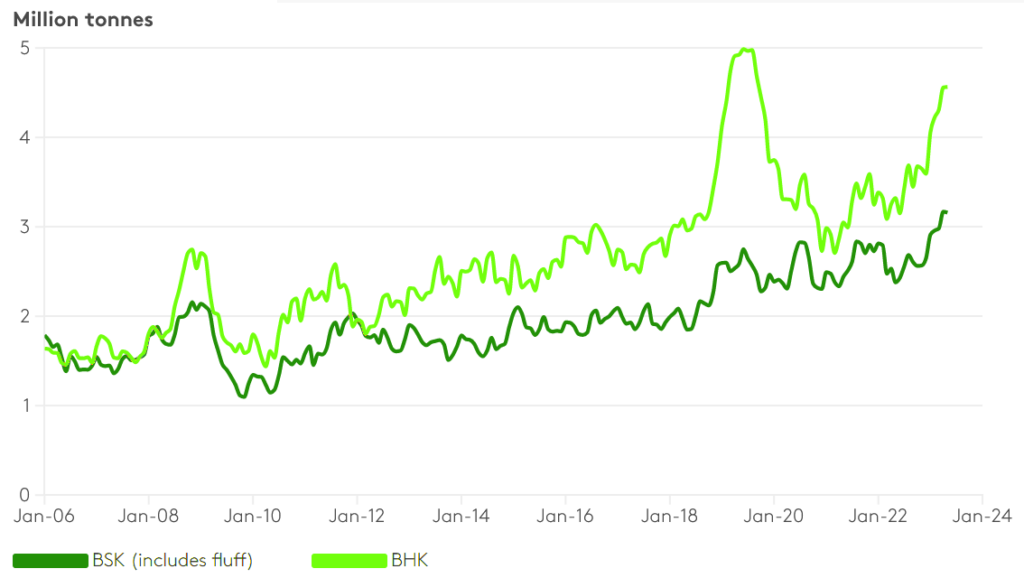

The real showstopper is the glaring imbalance between bleached softwood kraft (BSK), including paper grade and fluff pulp, and its counterpart, bleached hardwood kraft (BHK).

Pulp producer inventories are on the rise again since the start of 2023

But let’s not pop the confetti just yet. This inventory extravaganza comes with its share of drama. As demand seems to be taking a bit of a snooze and new supply confidently waltzes in, the market is left with a lingering question mark. Will this inventory bulge stick around for an uncomfortably long time?

Over the next three years, the global market will see a massive influx of over 7.4 million tonnes of new, low-cost kraft pulp supply from five ambitious projects. Chile, Uruguay, Finland, Brazil – these powerhouses are set to transform the pulp industry!

BEK Arauco MAPA project in Chile ramping up with a capacity of 1.56 million tonnes, targeting 800,000 tonnes of BEK production this year.

BEK Arauco MAPA project in Chile ramping up with a capacity of 1.56 million tonnes, targeting 800,000 tonnes of BEK production this year.

UPM’s Paso de los Toros greenfield mill in Uruguay aiming for full operation by year-end, boasting a capacity of 2.1 million tonnes. Metsä Fibre’s new Kemi mill in Finland set to add approximately 880,000 tonnes of fresh pulp supply by Q3 2023.

UPM’s Paso de los Toros greenfield mill in Uruguay aiming for full operation by year-end, boasting a capacity of 2.1 million tonnes. Metsä Fibre’s new Kemi mill in Finland set to add approximately 880,000 tonnes of fresh pulp supply by Q3 2023. CMPC expanding BEK capacity at Guaíba mill in Brazil, adding 350,000 tonnes by Q4 2023.

CMPC expanding BEK capacity at Guaíba mill in Brazil, adding 350,000 tonnes by Q4 2023. Suzano’s upcoming 2.55-million-tonne BEK Cerrado mill in Brazil to be operational in H2 2024, propelling the pulp industry to new heights

Suzano’s upcoming 2.55-million-tonne BEK Cerrado mill in Brazil to be operational in H2 2024, propelling the pulp industry to new heights

Rebalancing Inventories: The Role of Temporary and Permanent Mill Downtime and Closures

As the global market pulp capacity gears up for a significant expansion with five ambitious projects, the pulp industry faces the challenge of balancing inventories amidst this influx. Downtime and closures will play a crucial role in achieving this delicate balance, as they draw down producer inventories and integrate the new capacity into the market seamlessly.

Downtime can arise from unexpected events like the Svetlogorsk mill explosion in Belarus and the ongoing impact of Canadian wildfires on BSK supply. Additionally, production slowdowns, such as Suzano’s decision to reduce its annual BHK operating rate in Brazil, contribute to the efforts to manage inventory levels effectively throughout the year.

Various producers are adopting temporary curtailments to navigate through this period. For instance, Paper Excellence’s Crofton mill is taking downtime in July, and International Paper is implementing economic downtime during the fourth and first quarters.

However, some closures carry the risk of becoming permanent, exemplified by Stora Enso’s recent decision to shutter its Sunila BSK mill in Finland later this year, highlighting the elevated closure risk during a pulp market downturn.

Short-Term Pulp Demand Dictated by Inventory Cycle Shifts

In the short term, pulp demand is closely tied to shifts in the inventory cycle, especially in North America and Europe. However, large volume pulp restocking actions in these regions remain subdued, with buyers seemingly waiting for pricing on a net basis to align with net prices in China, where global markets have experienced a significant downward correction.

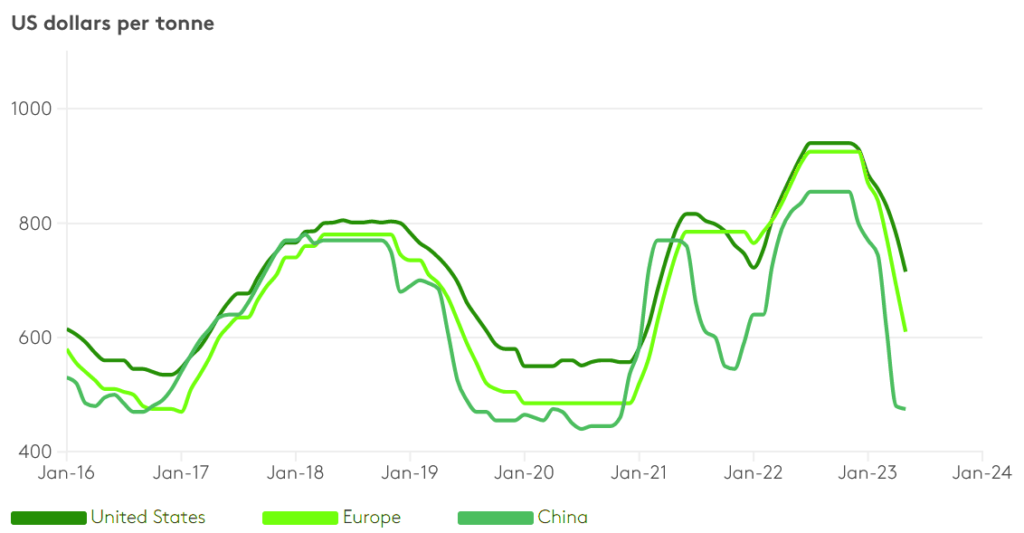

In Q2 2023, the Chinese market saw a surge in demand for imported BHK as buyers were lured back by offers under $500 per tonne. This was fueled further by high hardwood chip import prices, making it economical for integrated pulp and paper producers to opt for imported BHK over domestic pulp production with imported chips.

In the realm of softwood, the Chinese market is witnessing an interesting trend. The significant spread between benchmark northern bleached softwood kraft (NBSK) and bleached eucalyptus kraft (BEK) is favoring substitution for hardwood.

China’s BEK price collapse triggered price drops in the US and Europe

To leverage this advantage, Canadian and Scandinavian NBSK producers are taking strategic measures. They are lowering prices to encourage restocking demand from consumers and traders, while also aiming to secure a larger market share by outpacing their competitors.

This dynamic shift in pricing and strategy is poised to have a considerable impact on the softwood segment of the pulp market, with potential ripple effects on global market dynamics.

Production Costs Take Center Stage for Pulp Producers

In the current market cycle, production costs have become a critical factor for market pulp producers like never before. The swift decline in prices for both bleached softwood kraft (BSK) and bleached hardwood kraft (BHK) has pushed profitability to the edge and, in some cases, even led mills into the red.

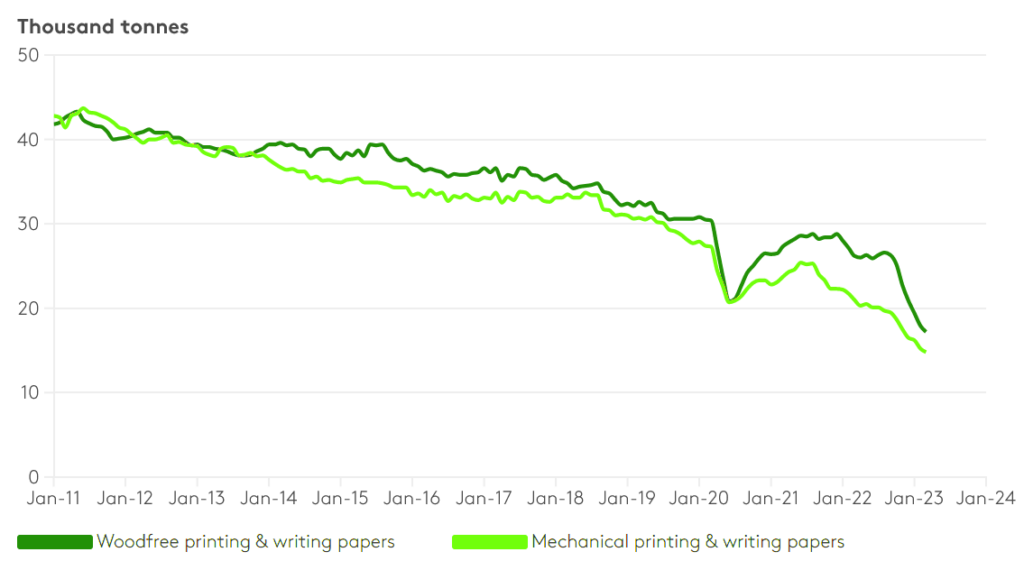

The volume of European woodfree and mechanical printing & writing paper shipments are decreasing

Unlike the previous two years, which witnessed a rollercoaster ride of rising and volatile transportation, energy, chemical, labor, and wood costs, today’s market is showing signs of cost deflation in certain regions and industry components.

Pulpwood and woodchip markets have experienced a reduction in pressure as the downturn in paper and board markets eased the demand for wood fiber. This easing allowed for price declines in woodchips in the high-cost Chinese BHK market and the British Columbian BSK market.

In Europe, the scenario is similar, with lower natural gas and electricity rates providing relief for pulpwood markets from bioenergy producers, and simultaneously facilitating a decline in energy and chemical costs.

Market Risks and Drivers to Monitor for the Pulp Industry

In the ever-changing landscape of the pulp industry, players need to be vigilant about additional market risks and drivers that could influence the course of events. While risks are predominantly leaning towards the downside, there’s still a glimmer of upside potential to keep an eye on.

One key player to watch closely is the Chinese government, which has ramped up efforts to bolster its economy. As the recovery gains momentum, it could have a positive impact on industrial production and the property sector, subsequently boosting paper and board markets. This, in turn, may prompt a significant pulp restocking effort in the market.

Another major factor to consider is the US economy’s resilience to high-interest rates. If the Federal Reserve decides to cut interest rates in the coming quarters, it could weaken the US dollar’s strength. This, in turn, would offer support to pulp prices, as it raises dollar-denominated production costs and increases the purchasing power of pulp buyers, especially in China.

As observed in past pulp pricing cycles, unexpected downtime remains a wildcard. A sudden tightening of supply due to unplanned mill outages could alter buyer confidence in future pulp availability.

Moreover, the record-high pricing environment from the previous year is still fresh in buyers’ minds. Any unexpected outage or closure of a major pulp mill could act as a catalyst, prompting buyers to stock up on relatively inexpensive pulp before the next major pricing cycle unfolds.

In this dynamic market, staying informed and ready to adapt to these risks and drivers is essential for success in the pulp industry. Coniferous is here to support, and help you remain alert and proactive to seize the opportunities that lie ahead.