The capital boom in the Paper Manufacturing Industry

We’ve written at length over the previous two years on the pandemic’s many effects on the pulp and paper manufacturing industry, particularly the Tissue & Towel and Containerboard divisions, which were frequently forced to push ageing machinery to its maximum. Aside from market-driven shifts, the pandemic has posed immediate hurdles for manufacturers, which are dealing with personnel constraints and operational problems.

Suppliers and service employees continue to encounter challenges as travel restrictions are implemented in many areas of the world as we start one more year immersed in pandemic uncertainties. When it comes to delivering service, engineering, and installation services, contractors, especially, are encountering challenges. We wondered what influence if any, this trend has had on the paper trading company‘s capacity to reinvest in critical equipment at plants throughout the globe.

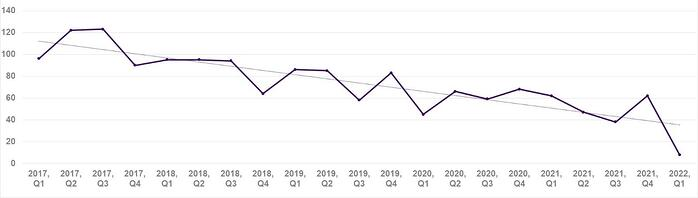

In 4Q2021, total new worldwide machine builds (counting restarts and starters of used machines) fell to their lowest level in recent years. While we are only in the first part of 2022, we can see in the graphic below that 8 units have been put online to date, indicating that new installations must pick up to stay up with the pace established in 2021.

Machine Upgrades in Paper Manufacturing Industry

MACHINE STARTS – NEW, SECOND HAND, RESTARTS

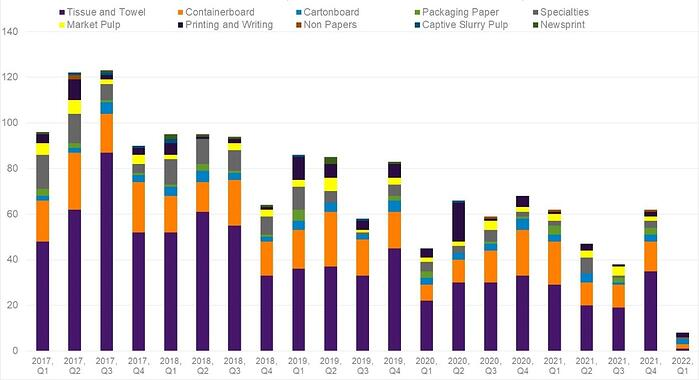

Machine upgrades in 2021, apart from Latin America, fell dramatically, as shown in the graph below, showing a slowdown of investments in paper machinery and pulp dryers. This came right after 2020, the year in which the sector saw a slew of irreversible and temporary mill shutdowns, ranging from three weeks to months. COVID-induced mill shutdowns occurred as a result of the drop in demand in several sectors, like Printing and Writing, by August of the same year, resulting in a 2.5 MM tonne reduction in the paper and pulp market.

MACHINE UPGRADES

These patterns are early warning signs of ageing assets in the P&P business, and they’re especially problematic given the paper manufacturing industry’s continuous demand growth in many areas. Nonetheless, while there are a few new machines being constructed and improved, most of them are designed for high segments that are likely to continue to grow, as seen in the graphic below. While we’ve just examined paper machines and pulp dryers so far, similar trends may be found in other mill sectors.

NEW MACHINE STARTS, RESTART AND SECOND HAND MACHINE STARTS

We anticipate business to build up in some categories as economies progressively reopen, resulting in a desire for equipment that can effectively make high-quality items. With several pulp and paper industries expected to generate cash in 2021 as a result of tight markets and higher pricing, pulp and paper providers may be on the verge of some exciting prospects.

In light of these changes, manufacturers and suppliers of pulp and paper should examine the following questions:

- Can these slow new installations and machine improvements keep up with rising demand?

- How would the grade of goods produced be affected by these ageing assets?

- What would this entail for mills with older machinery when demand for certain segments rises?

- Who has the best chance of making these investments?

Analysing the results will assist you in developing an executable strategy with a fair degree of precision, providing the confidence and security required to maximise your judgement.