Caustic Soda Chronicles: Navigating Its Impact In The Pulp And Paper Industry

This content is being republished with the consent of Fisher International and ResourceWise. Read more about Caustic soda consumption in P&P industry at ResourceWise. July 12’23

The consumption of caustic soda in the pulp and paper industry is skyrocketing alongside the market’s growth. Over the past seven years, the industry has witnessed a steady average annual growth rate of around 1.5% in caustic soda consumption. Despite a minor slowdown in 2020, the growth rate has bounced back significantly since 2021. Looking ahead, our projections indicate an impressive 9% surge in caustic soda consumption by the end of 2023 compared to 2019 levels.

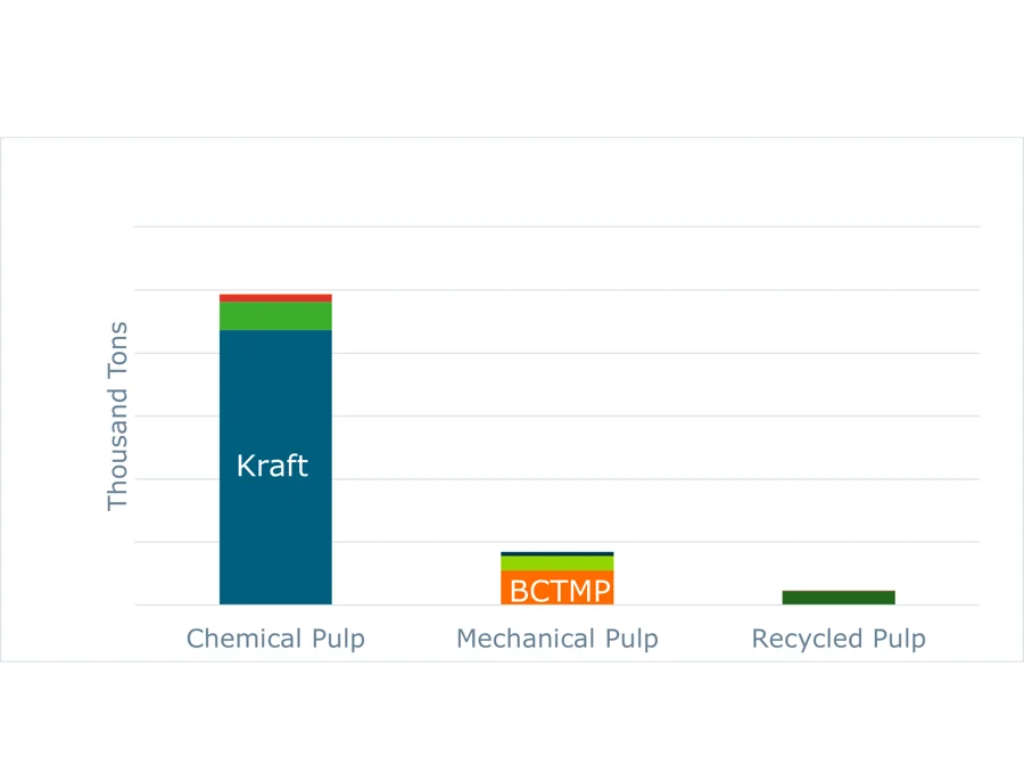

Caustic soda plays a vital role in the fiber lines and paper machines during pulp production. It starts its journey in the fiber line and then moves on to fuel the paper machine. In terms of pulp grades, chemical pulp, mechanical pulp, and recycled pulp take the stage. Among these grades, caustic soda takes center stage in chemical pulp, accounting for a dominant 80% of total consumption.

Within the realm of chemical pulp, kraft pulp steals the show, guzzling over 90% of the caustic soda consumed by chemical pulps. In mechanical pulps, bleached chemi-thermomechanical pulp (BCTMP) stands out as the primary consumer of caustic soda, while recycled fiber requires a lesser amount.

Caustic Soda Consumption by Major Pulp Grade

©[2023] Fisher International (ResourceWise). All rights reserved.

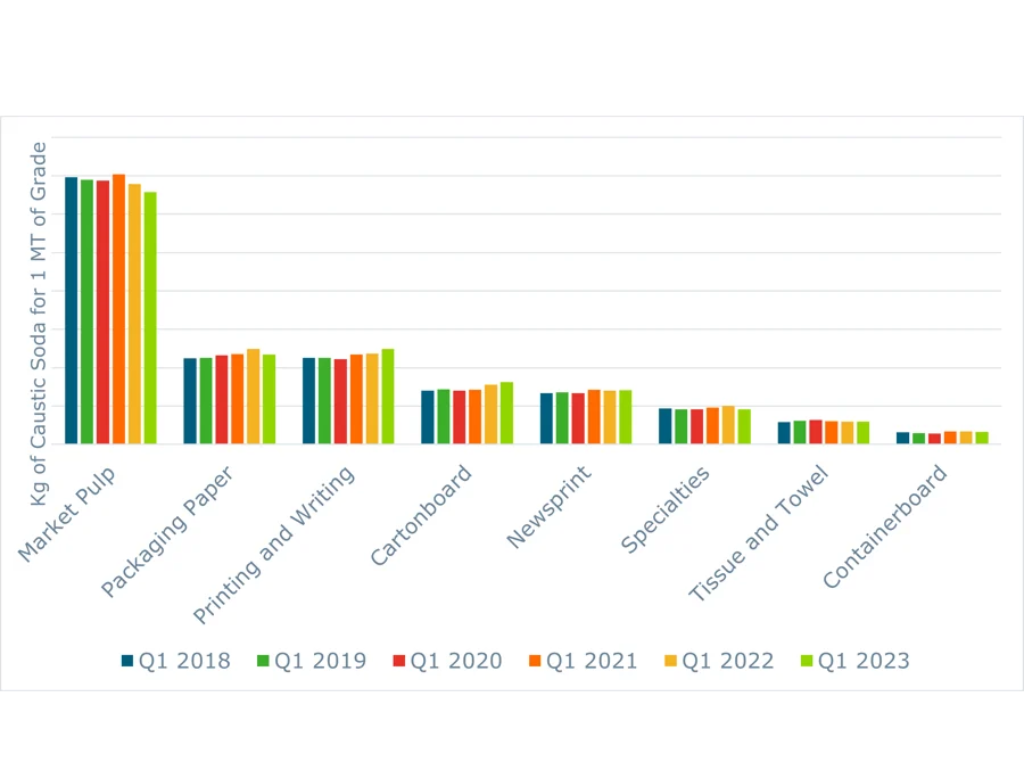

When it comes to paper production, the unit consumption of caustic soda has remained relatively stable in recent years. Market pulp claims the lion’s share of caustic soda consumption, requiring approximately 35kg to produce one ton of market pulp. On the other hand, packaging paper and printing and writing paper, the second and third largest consumers, necessitate significantly less caustic soda compared to market pulp. The consumption of caustic soda in different paper grades depends on the type of pulp used and whether the mill is integrated.

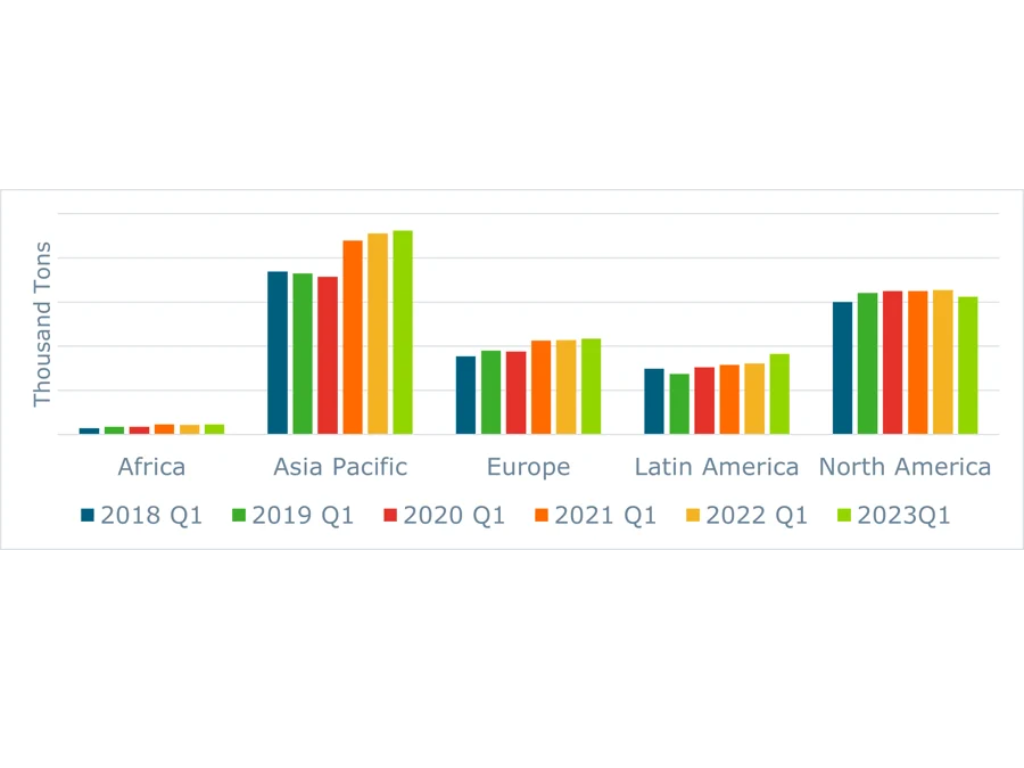

Caustic soda consumption exhibits regional variations, with countries boasting higher paper production rates naturally showing higher consumption rates as well. The giants in caustic soda consumption in the pulp and paper industry are China and the US. However, Brazil, Canada, and Indonesia also play notable roles due to their substantial production of market pulp and integrated pulp. Together, these top five countries account for a significant 65% of caustic soda consumption in the industry.

Caustic Soda Consumption by Major Paper Grade

©[2023] Fisher International (ResourceWise). All rights reserved.

©[2023] Fisher International (ResourceWise). All rights reserved.

Regional consumption trends tell intriguing stories. In recent years, we’ve witnessed a remarkable increase in caustic soda consumption in APAC (Asia-Pacific) and Latin America. The growth in APAC is primarily fueled by integrated pulp, while Latin America’s surge is driven by market pulp. Looking ahead, we anticipate this consumption trend to continue rising in these regions.

Join us at Coniferous as we delve into the depths of caustic soda’s influence in the pulp and paper industry. Together, let’s embark on an exhilarating exploration to unlock the boundless possibilities that caustic soda holds for the pulp and paper sector.