Into the Woods: The Economic Puzzle Facing Our Industry

This content is being republished with the consent of Fisher International and ResourceWise. Read more about Pulp and paper industry at ResourceWise. Dec 27, ‘23

As the economic landscape remains as static as a pine tree in winter, the forest products industry finds itself in a bit of a sticky situation, thanks to global conflicts and the persistent inflation saga. So, how does our beloved industry weave its way through this tangled thicket of challenges?

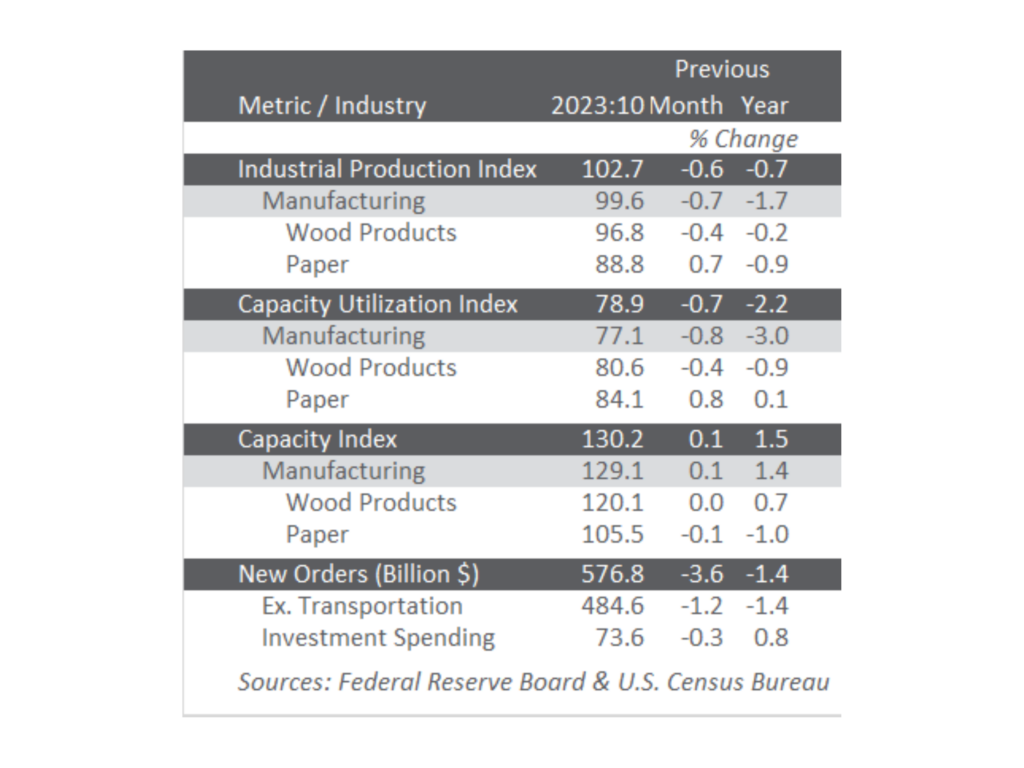

October’s Industrial Production Rollercoaster

After September’s optimistic +0.4% got a reality check and was revised down to +0.2%, October’s total industrial production took a nosedive with a 0.6% drop. That’s a -0.7% decrease year-over-year, folks. Manufacturing output joined the downward dance with a 0.7% fall, marking its eighth consecutive month of dips. Why the gloom? Well, a 10% slump in motor vehicle and parts output due to some serious strikes at major manufacturers certainly threw a wrench in the works. Take away the vehicular drama, and manufacturing just about managed a 0.1% uptick.

Utilities decided to chill out with a 1.6% decrease, while mines cranked it up a notch with a 0.4% increase. New factory orders, however, decided to pull a Houdini act, plummeting by 3.6%, led by a -5.4% freefall in durable goods—especially commercial planes, which went from soaring 91% in September to a jaw-dropping 50% drop. Nondurable goods orders and business investment spending tiptoed lower by -1.9% and -0.3% MoM, respectively.

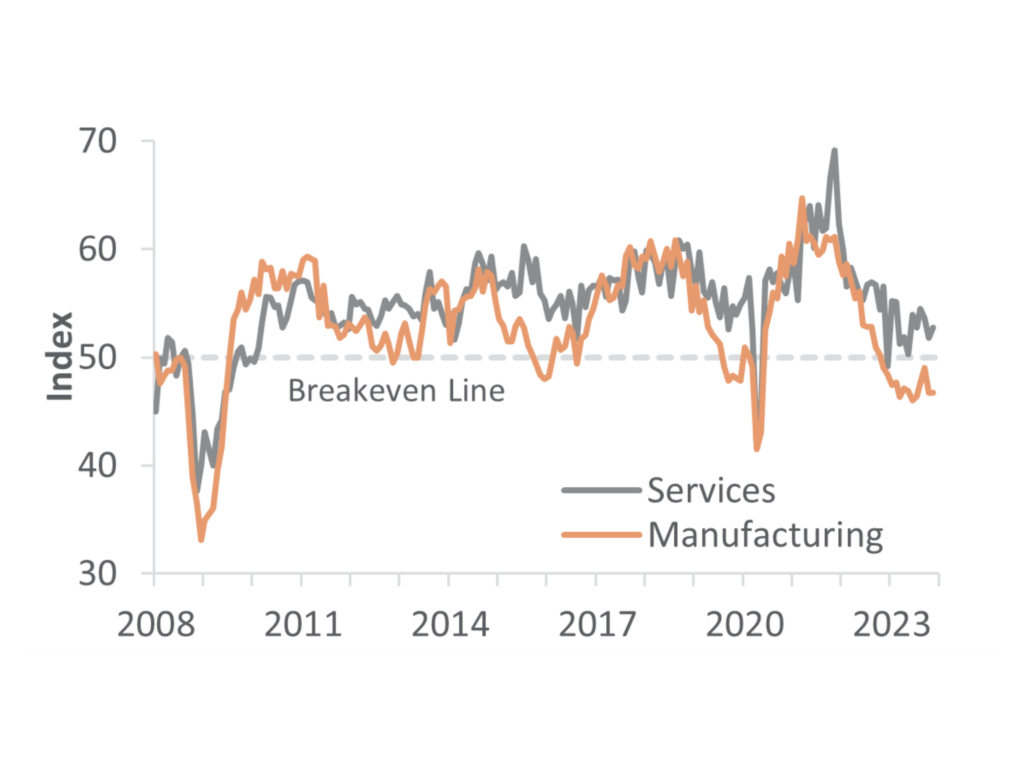

Survey Says: Manufacturing Sector Holds Its Poker Face

According to the Institute for Supply Management’s (ISM) monthly sentiment survey, the rate of contraction in the US manufacturing sector in November remained as poker-faced as a lumberjack during a game of poker. The PMI held steady at 46.7%, marking the 13th month in contraction (and we thought 2020 was rough). The customer-inventories index was the only thing that refused to join the contraction party, which stayed above 50.

Paper products led the downward charge in industries reporting a downturn. On the flip side, the services sector decided to pick up the pace with a +0.9 percentage point boost to 52.7%.

ISM’s GDP estimates ranged from -0.7% (manufacturing) to +1.0% (services), making us wonder if the forest products industry is the secret hero of the economy.

Consumer Price Index

Shelter vs. Gasoline Duel In the realm of consumer prices, October’s CPI stood essentially unchanged (+3.2% YoY), thanks to a shelter index rise countering the gasoline index retreat. The energy index experienced a 2.5% MoM fall, with the gasoline index taking a 5.0% nosedive. Food, ever the steady companion, increased by 0.3% in October. On the flip side, the producer price index (PPI) decided to play the contrarian, falling 0.5% (expected +0.1%).

Year-over-year, October’s final demand index rose 1.3%, with final demand goods taking a 1.4% MoM plunge, primarily due to a 15.3% drop in gasoline prices. Final-demand services stood their ground, remaining unchanged on the net.

Forest Products Sector

Weathering the Economic Storm Now, let’s dive into the lush green world of the forest products sector, where price indexes are holding on tight:

- Pulp, Paper & Allied products: -0.2% (-0.1% YoY)

- Lumber & Wood Products: -0.3% (-6.5% YoY)

- Softwood Lumber: -3.2% (-16.3% YoY)

- Wood Fiber: +0.1% (-2.5% YoY)

Amid this economic rollercoaster, Coniferous stands tall, adapting and weathering the storm. Stay tuned as we continue to chart the course through economic thickets because when it comes to the forest products industry, we’re the tree-mendous experts.