Navigating Troubled Waters: Red Sea Crisis Disrupts Global Shipping and Sparks Economic Ripples

As we embark on the journey into a new year, filled with hope and optimism, it is with a sense of responsibility that we bring to your attention a pressing matter that has recently emerged — the Red Sea crisis. While we extend our warmest New Year wishes to you, it is crucial to shed light on the complex web of challenges that the shipping industry is currently grappling with.

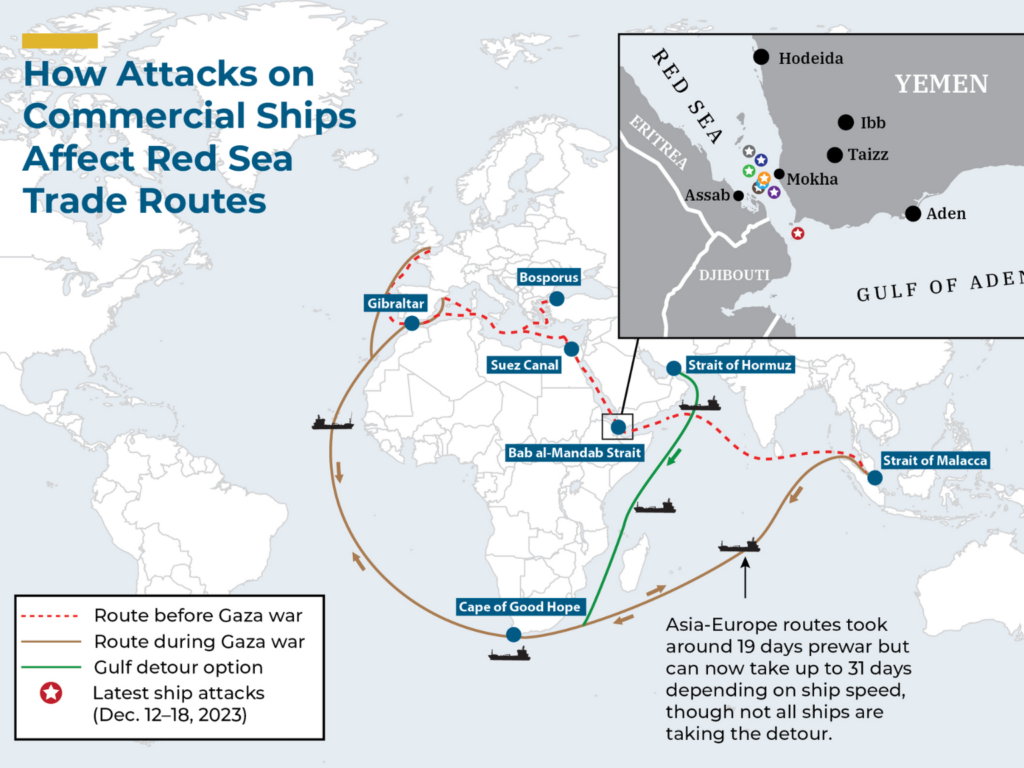

In a disconcerting turn of events, Houthi rebels have targeted container ships in the Red Sea, setting off a chain reaction of consequences that extend far beyond the maritime domain. This unfortunate development has not only disrupted the smooth flow of global trade but has also triggered a series of economic ramifications.

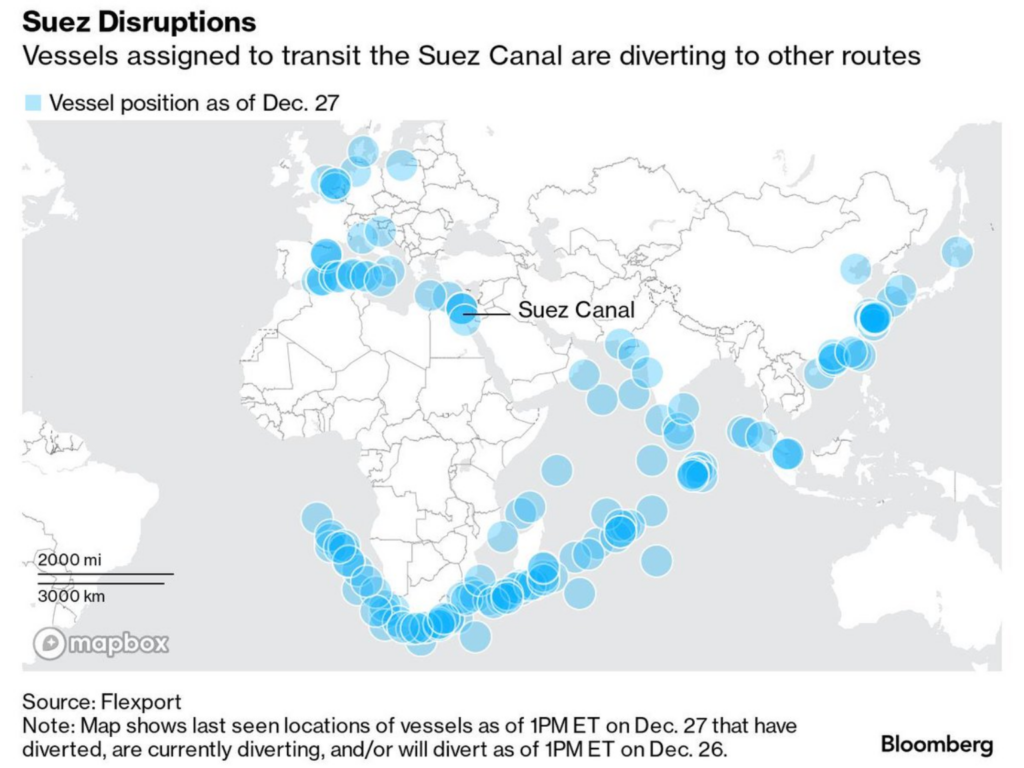

The primary impact stems from the longer routes ships must now navigate, circumventing the Suez Canal and moving around the Cape of Good Hope. This has resulted in a significant escalation in freight rates, reaching a two-year high and causing a ripple effect throughout the shipping space. The extended transit time of upto 2 weeks, will also mean lower space, and higher fuel costs. This would further fuel an increase in the freight rates.

To offer a more comprehensive view, let’s delve into the specifics of freight rates from various Ports of Departure to Ports of Lading during the first and last weeks of December:

First week of December (USD/40 ft Container)

| Jebel Ali | Hamad | Sohar | Bahrain | |

| Shenzhen | 1200 | 1350 | 1350 | 1200 |

| Singapore | 700 | 750 | 700 | 900 |

| Mundra | 125 | 250 | 300 | 450 |

Last week of December (USD/40 ft Container)

| Jebel Ali | Hamad | Sohar | Bahrain | |

| Shenzhen | 2100 | 2200 | 2200 | 2500 |

| Singapore | 1600 | 2400 | 2400 | 4000 |

| Mundra | 450 | 625 | 650 | 800 |

The impact is particularly pronounced on ports in Europe, the United States East Coast, and Mediterranean ports. While African ports have experienced minimal effects, experts anticipate a potential resolution of the Suez Canal issue in the first quarter of the New Year.

In addition to the surge in freight rates, shipping lines are imposing extra charges such as War Risk Surcharge and Long Voyage Surcharge, amounting to an additional USD 2000 per container.

In addition to the same, recent regional tensions remain high, as the United States and it’s allies put together a global marine task force, however geopolitical analysts believe that if the issue is not handled properly it could spiral into a war. 7 out of the 10 biggest shipping lines, have stopped all service to the Red Sea ports and have either cancelled service or re-routed. This would affect over 30% of the global container space.

Apart from the Red Sea issue, there is another issue at the Panama Canal, where the water level at the canal is the lowest ever, causing a major shipping jam. About 100+ ships are waiting to cross the canal, to avoid going around South America. This has caused another choke on the global shipping industry.

The Far-reaching Effects:

Price Surge: Expect an increase in prices primarily due to elevated freight costs. The situation is anticipated to stabilize as the shipping industry balances equipment and tensions in the Gulf of Aden and Red Sea subside. Whilst there is optimism that with the global intervention, the shipping lines would resume service, the industry takes 3 – 6 months to normalize post any disruption.

Price Surge: Expect an increase in prices primarily due to elevated freight costs. The situation is anticipated to stabilize as the shipping industry balances equipment and tensions in the Gulf of Aden and Red Sea subside. Whilst there is optimism that with the global intervention, the shipping lines would resume service, the industry takes 3 – 6 months to normalize post any disruption. Inflationary Pressures: The rise in prices may contribute to accelerating inflation, leading to tighter monetary availability in the first quarter and decreased forward demand. Further converters will be under pressure to fulfill contracts and demands as Q3 and Q4 have relatively seen subdued pricing.

Inflationary Pressures: The rise in prices may contribute to accelerating inflation, leading to tighter monetary availability in the first quarter and decreased forward demand. Further converters will be under pressure to fulfill contracts and demands as Q3 and Q4 have relatively seen subdued pricing. Transshipment Port Congestion: Extreme congestion in transshipment ports may lead to short-term stockpiling in warehouses as containers with different voyages are combined on the same journey. Also, vessels might not get space to dock at the ports on time, causing delays in container movement.

Transshipment Port Congestion: Extreme congestion in transshipment ports may lead to short-term stockpiling in warehouses as containers with different voyages are combined on the same journey. Also, vessels might not get space to dock at the ports on time, causing delays in container movement.

Supply Chain Disruptions: The potential disruption in the supply chain could impede factories from receiving raw materials on time, affecting production. For instance, the GCC Tissue Mills rely on Wet Strength from Turkey and Europe, facing possible slowdowns and interim shortages. Wet Strength and other chemicals have limited shelf life, and thus such chemicals cannot be stocked for extended time. This might cause a reduced short-term supply. Pulp shipments from South America and Indonesia will also be affected.

Supply Chain Disruptions: The potential disruption in the supply chain could impede factories from receiving raw materials on time, affecting production. For instance, the GCC Tissue Mills rely on Wet Strength from Turkey and Europe, facing possible slowdowns and interim shortages. Wet Strength and other chemicals have limited shelf life, and thus such chemicals cannot be stocked for extended time. This might cause a reduced short-term supply. Pulp shipments from South America and Indonesia will also be affected.

While these scenarios may appear hypothetical, preparedness is crucial for navigating the uncertainties that lie ahead. We will closely monitor the situation, seeking your support as needed, and providing timely updates.

In facing this challenge, let us remain resilient, as we have risen above adversities in the past. Wishing you success and prosperity in the upcoming year!