The Growth Trajectory for the Tissue and Towel Industry

With plenty of turmoil across the supply chain and the industry in general, the tissue and towel industry had now caught a breather as the world slowly and steadily unlocks. Coniferous is bringing all the industry updates to your fingertips. This article will discuss the potential growth factor contributing to the expansion of the tissue and towel industry and its various stakeholders.

Tissue and Towel (T&T), similar to the Packaging segment, has been a steady performer for our industry, even when other categories have struggled to keep up with the pace. Moreover, with the population of the planet rising at slightly over 1% annually, T&T demand is expected to rise as well. By 2025, the world’s population will have surpassed 8 billion (a rise of roughly one billion).

However, by 2025, how many additional tissue machines would be installed? What kind of technologies are they going to be? Who might create them? How large are they going to be? And how much extra revenue could suppliers anticipate as a result of such innovations?

Overview of Tissue and Towel Industry

The Pulp & Paper Sector, like every other sector of the economy, has its own “rationality”. Among them is the idea that T&T output increases in synch with population growth. If that were the case, China’s T&T potential would be a sliver of what it is now, given that China’s growth in population has averaged 0.5 percent each year over the last decade, whereas tissue capacity and tissue lines have nearly tripled. GDP is a big factor in T&T growth in the developing world.

The consumption of tissue per capita in emerging and developed nations are depicted in Figure 1. Turning the lever on per capita tissue demand in emerging nations would, without a doubt, have a far greater influence on the T&T industry than the growing population.

We created a model to monitor the installation trends of new tissue machines and the consequences for OEMs and other vendors. According to our calculations, there’ll be 1,040 new tissue machines created from now until 2025.

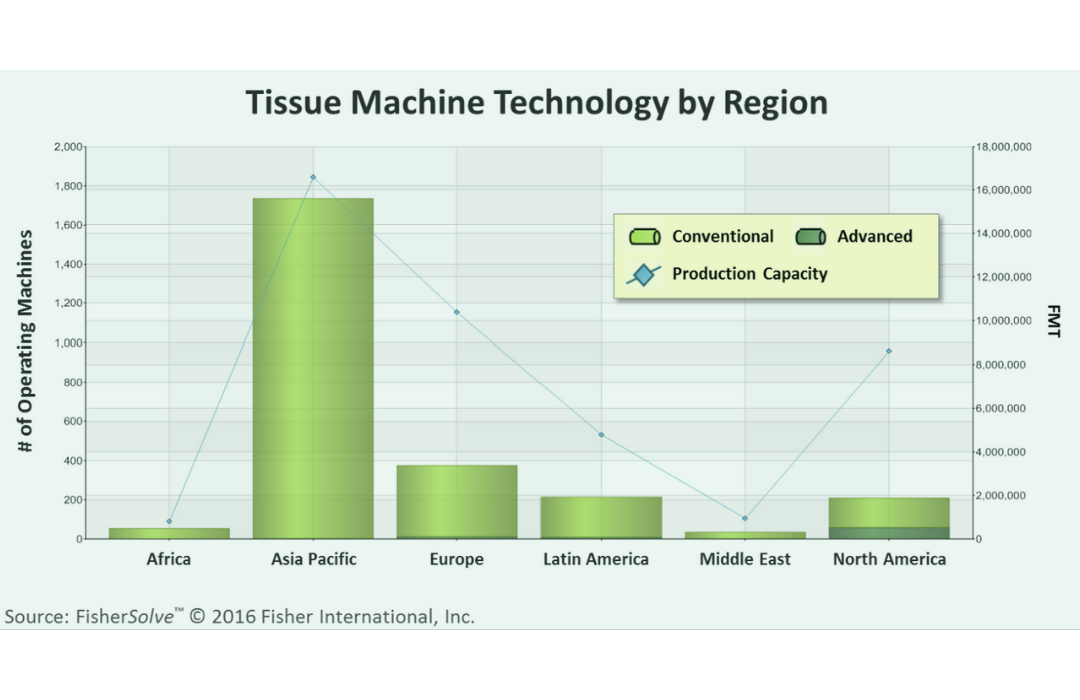

Over the last decade, a total of 1,114 fresh tissue machines have been added to the international fleet, having the Asia Pacific nearly tripling it, whereas North America has substantially dropped the number of tissue machinery in operation as seen below.

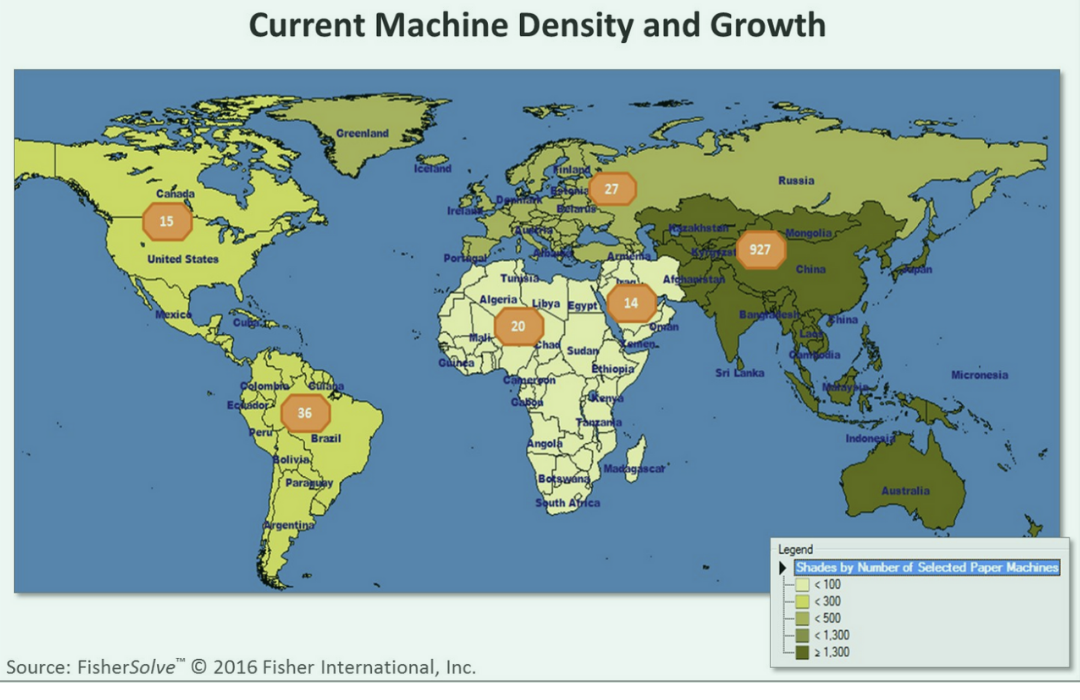

Our experts have been able to interpolate growth within each nation over a given period using our model and statistical data from the Capacity Trends Module, and as shown in the Figure below, the inclusion of additional machines in developing nations will be pretty consistent through 2025, whereas the inclusion of additional machines in developed nations will be essentially uniform and flat.

Likewise, when developing nations achieve balance in per capita consumption with industrialized countries, we predict the Asia Pacific to retain the bigger share of the tissue towel market, particularly China deploying most of the new tissue and towel machines. And, if history is to be believed, China’s typical per-machine manufacturing capacity will rise from 8,054 MTPY to 14,000 MTPY with the introduction of newer machines. As the older, smaller machines fall dormant, China’s average will rise.

Machines in Asia now generate less tonnage per machine on a global level. On the other hand, the North American zone has four times the output per machine and the biggest number of sophisticated equipment (TAD, e-TAD, NTT, ATMOS) equipment. Among these regions, rising nations will steadily boost the level of production per machine. Consumer preferences and energy prices will dictate the technological selection for new machines, which will be aligned with the level of growth in the nations covered. We do not see a large shift in the allocation of technology types in the future, since this is controlled by customer demand for product quality, which is less stringent in emerging markets.

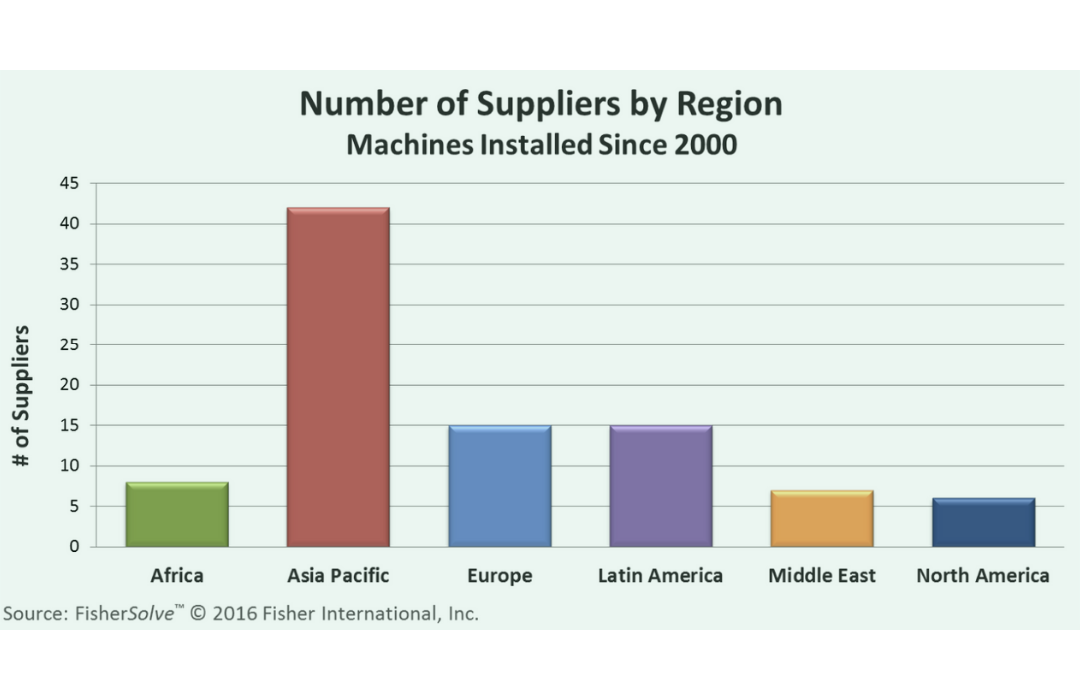

The scale and sophistication of such new tissue machines will vary from place to place and, in several cases, by nation, as will the providers of these new tissue machines. Regional suppliers, for instance, are preferred in the Asia Pacific, and there are many of them. Conventional OEMs, on the other hand, are prominent in North America.

The following figure depicts existing tissue and towel machine production including an approximation of the number of machines expected to be installed by 2025 for each location. The Asia Pacific area, as one might expect, has the largest existing output and, according to GDP predictions, will add the most machines in the upcoming years.

Suppliers benefit from more machines because they generate more income. According to recent research, assuming the current expenditure rate per tonne, the influence on suppliers will be substantially based on the expected worldwide number of machines. Chemicals, apparel, and MRO spending combined are anticipated to rise to $3.8 billion by 2025, a 27 percent increase over current levels as depicted in Figure 7. It is also projected that expenditure on pulps, raw materials, and energy would largely follow the trends seen in the consumable sector.

Whereas this higher spending is beneficial to suppliers, the number of mills that require maintenance and the lower per-mill investment than other parts of the business necessitate greater coverage. The bulk of the spending increases will occur in the Asia Pacific area, where the rise above current spending will be over 50%, necessitating additional resources to sell to and support mills.

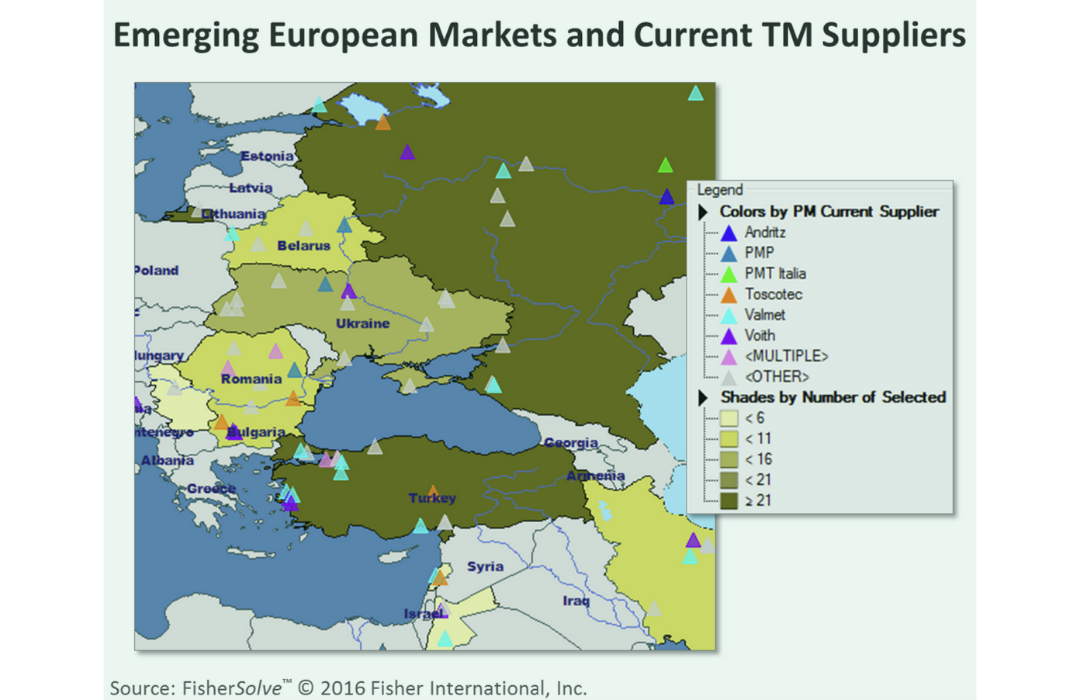

When deciding where all these machines will be deployed, mills must assess their ability to service their target customers effectively (e.g., 500 km). As an illustration, consider the Eastern and Central Europe regions. Georgia, Albania, and Turkey are among the emerging nations that are now tissue and towel producers in this sector. Bulgaria, Belarus, Romania, Serbia, Russia, Bosnia and Herzegovina, and Ukraine are among the countries involved.

Using 90 machines, these nations now generate 2.3 million metric tonnes of T&T. We estimate that an extra 30 machines would be installed by 2025, with a total output of 3.2 million metric tonnes, based on the expected GDP in each of these nations. Turkey, which is tops in GDP growth charts estimates among neighboring nations, will most likely see the most growth. Turkey’s geographic location and availability of ports allow it to service a number of nations, including nations in the Middle East.

Importantly, there’s really no dominant provider of current machinery in this area, as illustrated on the map. As a result, competitiveness for new equipment may be fierce, and transactions in emerging markets are largely dependent on price and the number of vendors in the tissue paper market.

Turkey’s capacity to manufacture at a low cost will be critical to its ability to supply beyond its own tissue towel market. They currently have a price advantage in terms of energy and labor as compared to the nations we’ve highlighted as prospective export markets; nevertheless, they have a high cost of pulp within that area. Will their advantageous energy stance be harmed if Europe imposes carbon emission taxes? Or will the taxes have an influence on raw material/pulp procurement? These are concerns that must be considered when approaching a tissue towel market as both a producer and a supplier.

New tissue machinery will be added either via additional mills or upgrades to the current mills. Newer mills will be established in places with easy access to adjacent markets and cost-effective access to the resources necessary. Mills that are relatively young, efficient, and logistically capable of expanding farther into suitable markets will most likely see higher expansion.

If there are new, bigger, lower-cost, and more proficient entries in any business, there are usually non-survivors as well. Smaller, older machinery and mills will be suspended if they can no longer keep up as evident in Figure 9. Currently, 26 machines with capacities of 246,000 MTPY in Central and Eastern Europe are in danger of being replaced due to the introduction of these newer machines.

Global growth trends can have significant ramifications for single providers. To illustrate, a decade ago, Europe and North America accounted for two-thirds of worldwide tissue and towel volume; now, they account for less than half. They will make up barely 30% of the population in the next decade.

This indicates that in less than one generation of sales professionals, competitive suppliers will have to drastically modify the position and focus of the bulk of their sales resources. It also indicates that many manufacturing plants will be relocated. Because of the cultural diversity between legacy and new clients, it’s possible that the kind of R&D required to support sales may evolve.

There are several more ramifications that will arise as a result of the upcoming developments in the tissue business. We at the Coniferous Multritrade will be keeping a close eye on the evolution of this tissue and towel industry, which presents an intriguing opportunity for business managers and strategists at both suppliers and producers. Coniferous is the leading supplier of environmentally friendly Kraft paper and luxury tissue products. Stay tuned for regular updates and stay in tune with the happenings of the industry.