Predicting the Trajectory of the Tissue and Towel Industry

The overall trade flows and supply chain had taken a major hit in the last couple of years owing to the rampaging pandemic across the globe. Over this time a strong sense of uncertainty and fear has permeated the industry as well as the market. However, there seems to be a light at the end of all this.

The tissue and towel segment of the paper and pulp industry has seen rapid growth during this time, although a major settling and reshuffling was seen since the start of the pandemic. The industry has evolved quite a lot since the pandemic era and is now quite ready to adapt to the new normal. Before we understand the growth trajectory of the industry, let us first explore some of the most

interesting facts about this sector.

Facts about Tissue and Towel industry

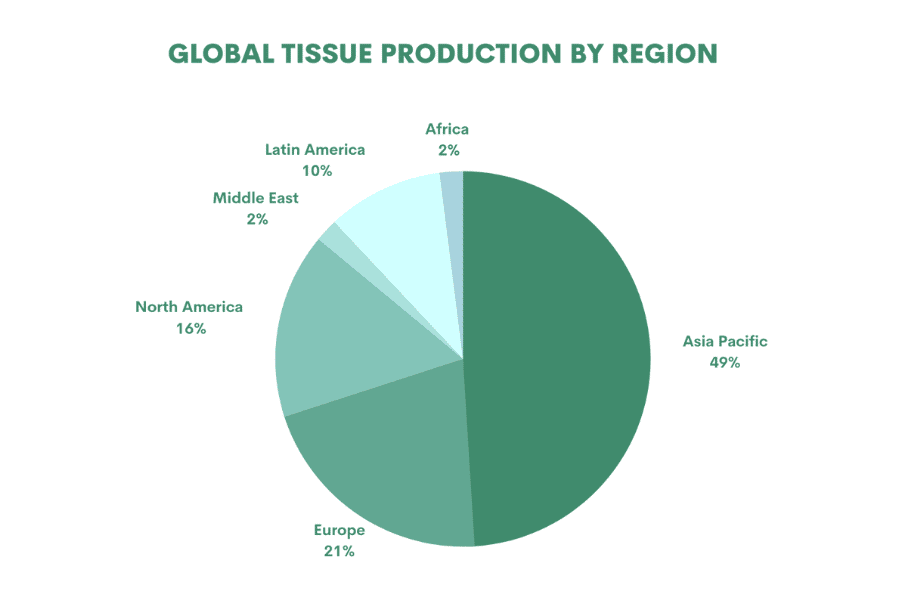

- A 60 million valuation: The tissue and towel industry accounts for at least around 10 to 15 percent of the global paper and pulp industry. Valued at a whopping 60 million, Asia stands to be the highest contributor to this sector having over half of the world’s tissue machine capacity.

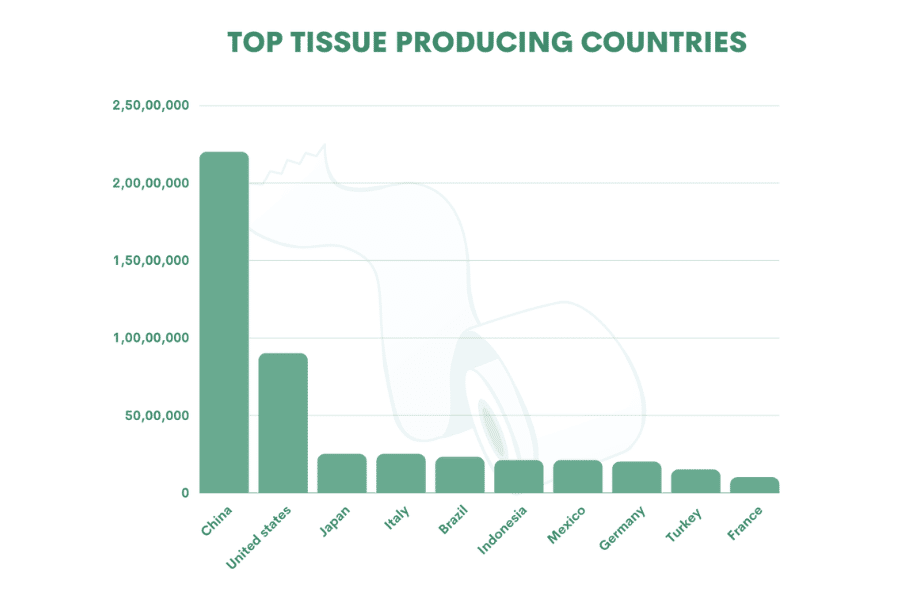

- Growing population: As the population explodes towards more and more urbanization, the demand for tissue and towel has seen a steeper rise. China is the largest producer of tissue and towel with the US being in the second spot. However, US’s production capacity is less than half of what China is capable of.

- A local business: Most of the tissue towel market stays locally focused meaning most producers are supplying their products to the local market. Unlike containerboards and pulp which are generally exported to far-away markets. Studies show that most of the EU or US tissue and towel products stay within their markets.

- Significant investments: Major investors are offering support to the industry with new technology and machine acquisitions. Most of the capital has been flowing to procuring new machines and enhancing capacity.

- China has been the highest beneficiary of these investments which accounts for Asia’s already rising production capacity.

- The US is still the tissue towel market leader for technology: Though on the back foot regarding the production volume, the US accounts for 90 percent of TAD, NTT, etc in the global tissue industry and market. This is due to the fact that US consumers have a high demand for better-quality products that are softer and more absorbent.

North American overview

With a 100-million-ton value excluding the US and Canada, the present North American and tissue towel market is likely to see a gradual 1 percent growth every year with net imports standing at 480,000 tons.

Although this region makes up the majority of the market, one-third of the producers are privately owned. The largest producers in the continent, fifty percent of the production is credited to the top three companies in North America.

Trends to keep an eye out for

Business prediction can be quite tricky during this uncertain time of the pandemic with the prediction not being reliable. However, this uncertainty can be eliminated by finding the risks, addressing them, and implementing the proper solutions in each scenario. Let us understand the risks before we try to plan for the scenario.

Can private label producers create a bubble capacity?

As evident from the annual one percent growth in the North American market, with an overall growth across the region for demand, there can be an excess capacity that is exceeding the gross demand for the region. Although the data shows the announced capacity, there is a possibility of additional demand in the coming years from now. On a deeper look, it is evident that this new capacity over the last few years will come from companies that are largely focused on the private label market.

Can the private label market accelerate demand to cope with the rising capacity?

To understand this, we need to understand the impacting factors on the growth trajectory.

Costs:

At the case level, the chart depicts a cost curve (supply curve). We can account for variations in advanced and traditional pressing using FisherSolve data. When implemented, we can observe that private labels may be low-cost and cost-effective, since half of the consumer advanced non-integrated mills in the first and second quartiles are private labels.

Quality:

In a recently released tissue research, North Carolina State University (NCSU) examined the retail price and absorbency of household paper towels. The findings demonstrated that private labels may compete with major brands on the shelf in the quality department. Will towel users pay 60–80 percent more for 10–20 percent higher absorbency, though, is the unanswered issue?

Inflation:

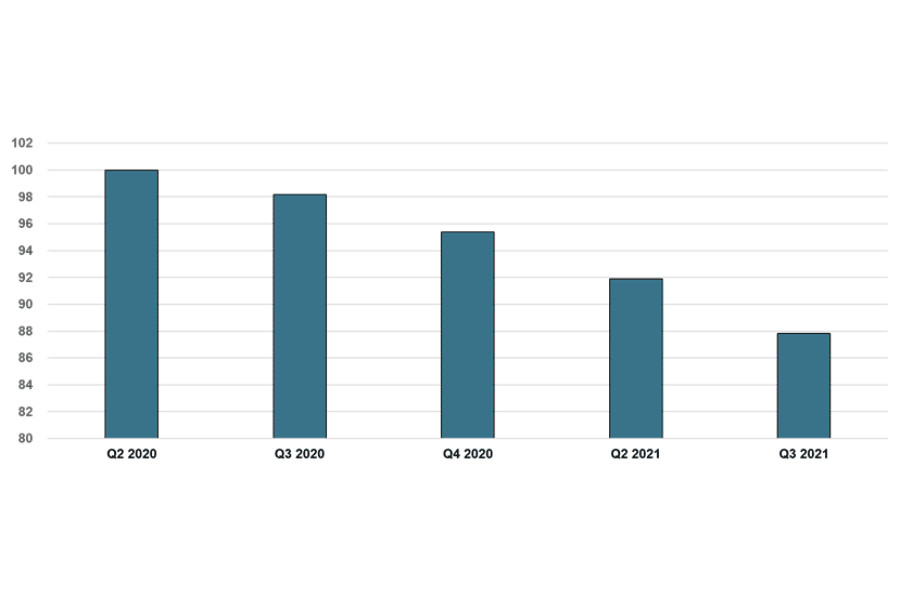

Consumer buying power is declining due to inflation, which has historically benefited private label businesses. According to FisherSolve data, average wages in the US for all wage workers declined by 12% in the third quarter of 2021 compared to the second.

All these factors are just a small drop in an unfathomable ocean. Private and public ownership is one of the most important dynamics governing the industry. With a steep decline in public ownership, it is important to understand the expectations of profit have an immense strategic implication for the industry. While public sector brands are looking for shorter ROIs, private labels can settle for

longer ROIs allowing for growth within private labels.

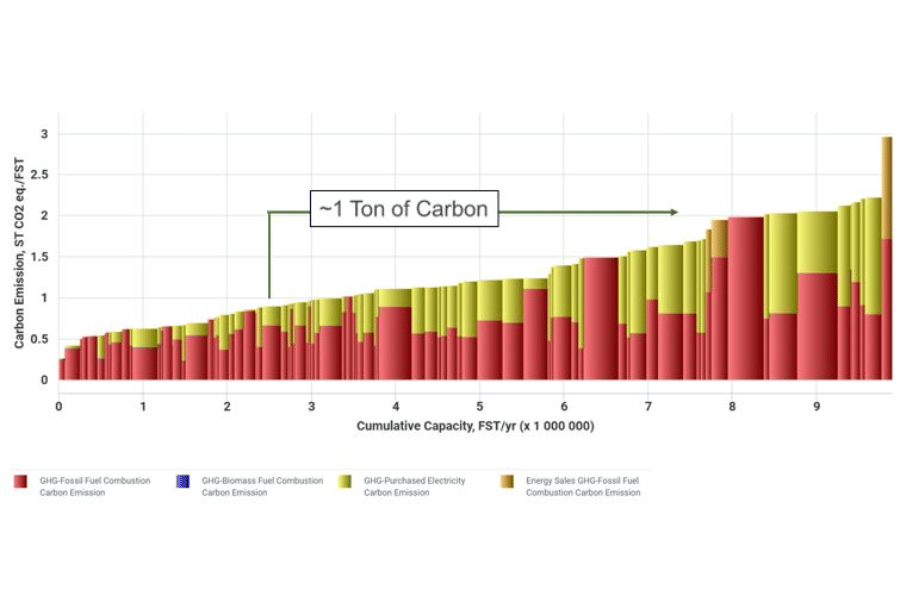

The role of carbon

Dealing with carbon is often associated with increased costs for the producers. With plenty of large consumer brands setting their sights on their carbon-neutral goals and with increased pressure from the public for carbon reduction efforts.

Governments too are pulling up their sleeves and bringing out legislation to leverage this newfound care for the environment. As evident from the figure, there is a significant difference in the amount of carbon emitted by US producers. Brands with a lower carbon emission are in an advantageous position in the market while the ones with the highest emissions are seriously at a risk.

In the coming years, the North American market will see surplus capacity as compared to demand however, demand will also continue to grow within this time frame. External factors like the war in Ukraine and the pandemic might create more uncertainty in the industry, however, low-cost producers will have the capacity to compete.