The global tissue industry: Embracing the new normal

The global tissue market has seen its share of ups and down owning to the pandemic. As the world is slowly adopting its back to the new normal, the tissue paper industry is bouncing back to newer heights. As the production and supply chain obstacles are getting omitted, the global tissue market is also embracing the new normal.

It would be an oversimplification to suggest that global geopolitics, trade flows, and economic systems are under strain. A feeling of heightened instability has pervaded our lives and the industries we rely on during the last two years, while there are glimmers of optimism and reasons to be optimistic.

Tissue and towel is one part of the pulp and paper market that is rapidly evolving. Ever since the outbreak of the epidemic two years ago, there has been some rearranging and settlement, and society appears to be eager to return to normality – whatever that would entail. The worldwide tissue industry also appears to be very different from what it was in 2019.

Tissue Paper Industry Facts

Here are some intriguing facts regarding the situation of Tissue and Towel presently.

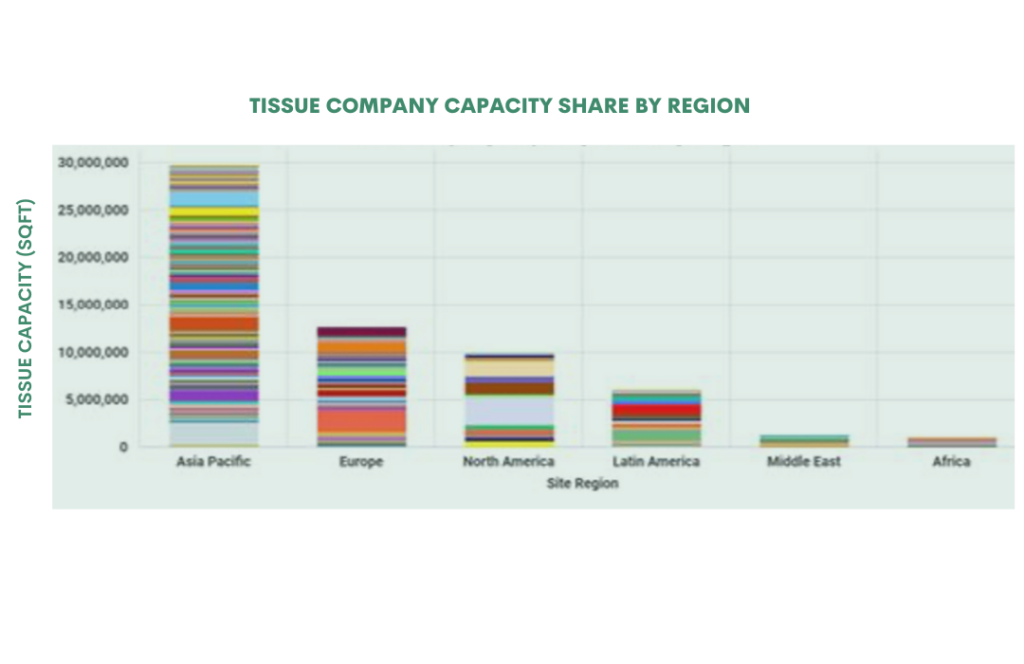

1. The worldwide tissue paper market is around 60 MM st, or about 10-15 percent of the worldwide pulp and paper industry. Asia now contributes about half of the world’s tissue machine capacity, as seen in the graph below.

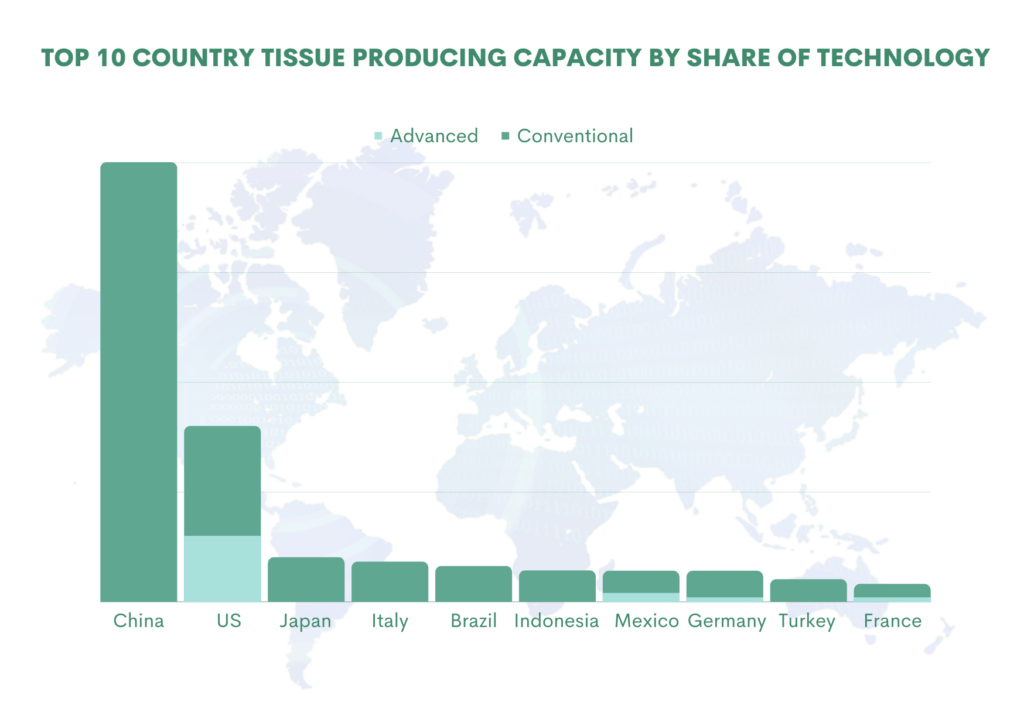

2. Tissue production is influenced by population and urbanization. The top tissue-producing countries are depicted in the graph below. China’s capacity dwarfs that of the following six nations combined; the United States, with around half of China’s capacity, is also a major tissue producer.

3. Tissue is a “regional” business. This ensures that most localized tissue production remains regional, as opposed to other grades like market pulp and containerboard, which are sent to distant markets. Approximately 95% of tissue manufacturing in North America and Europe stays in those markets.

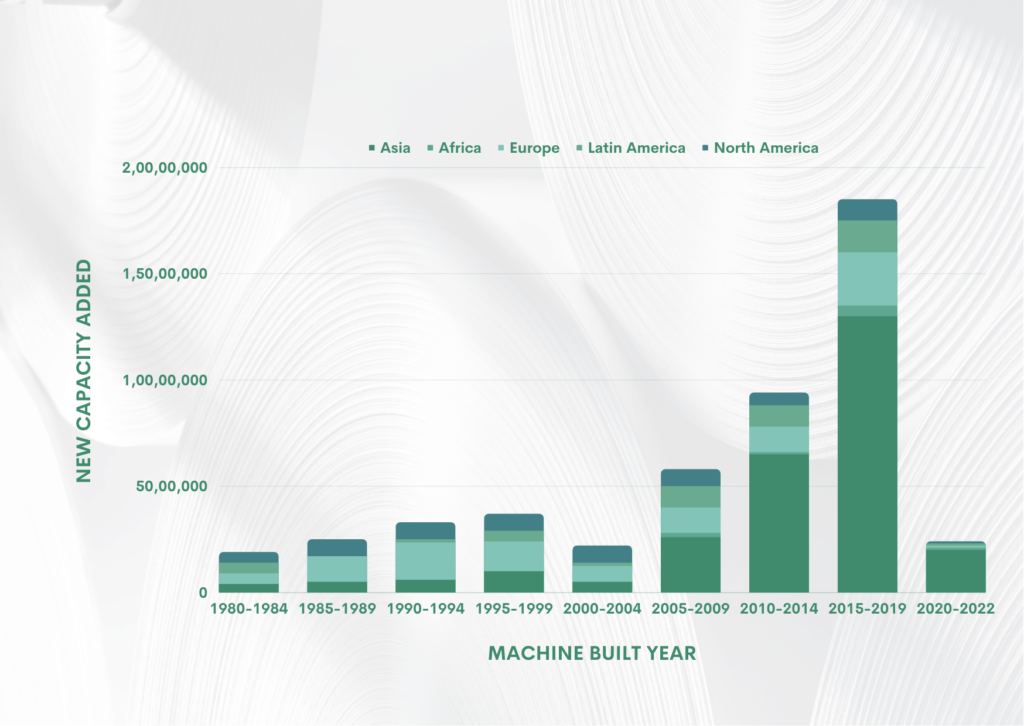

4. Asia has led the way in new tissue machine investment, accounting for 70% of total worldwide new machine capacity since 2010. The graph below shows new capacity by machine construction year, as well as where funding has been flowing. The majority of Asian investments have gone to China, resulting in a substantial overhang.

5. Around the world, the tissue supply is mostly fragmented – particularly in Asia. Companies rarely hold more than 20% capacity in any regional geography.

6. The dynamics of tissue are local, just like politics. The top ten worldwide tissue manufacturers and their production footprint are depicted in the graph below. Only two of the top ten corporations serve in more than two areas. This data supports the concept that tissue is a locally owned and operated enterprise.

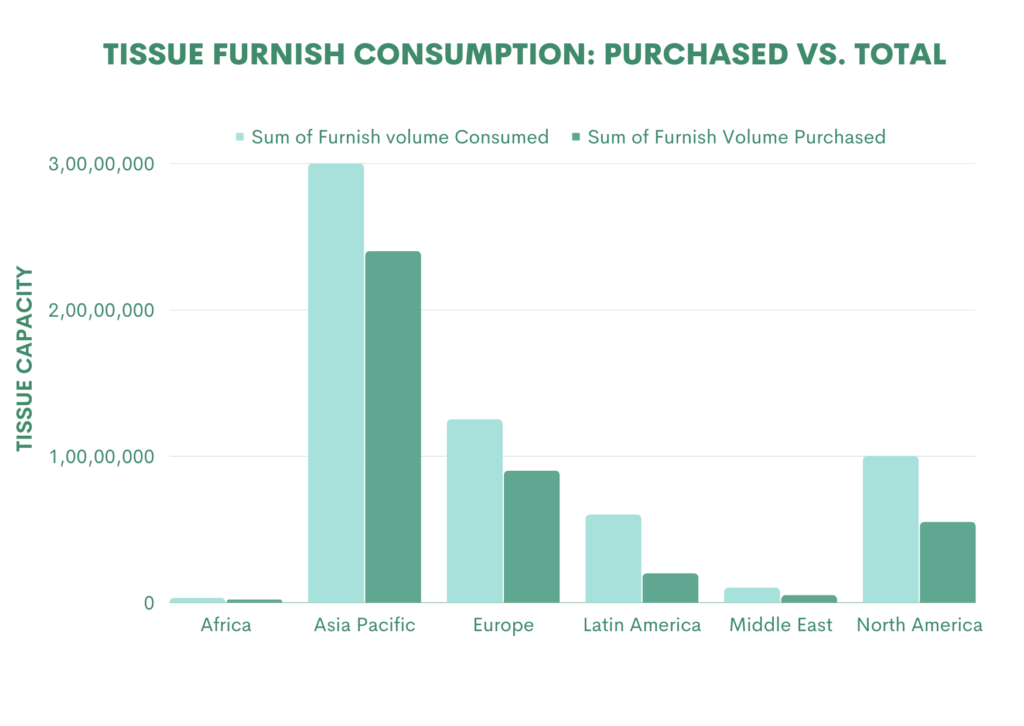

7. For most of the fiber needs, Tissue mills purchase pulp from the market — as shown below, over 80% of worldwide tissue is manufactured from the bought pulp. Given that pulp accounts for 60% of parent roll costs for the typical worldwide tissue mill, it should come as no surprise that it is also the single greatest cost driver.

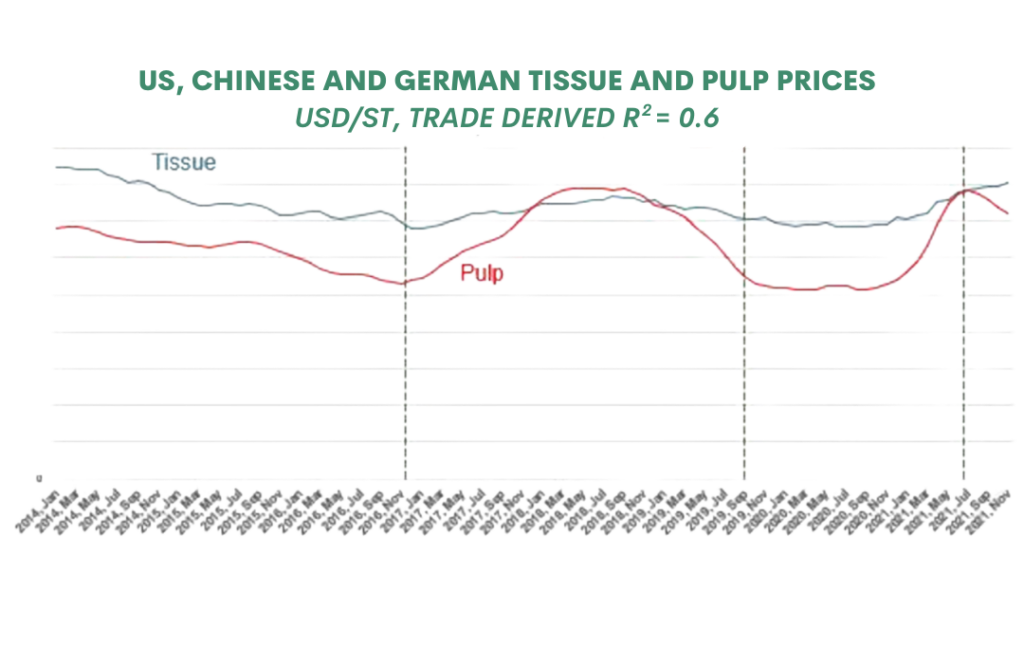

8. Tissue and pulp prices have turning points over the world. This leads to the price correlation, which is another characteristic of these marketplaces. We may evaluate the estimated commerce derived weighted tissue prices for specified locations using FisherSolve’s Market Module and acknowledge the strong correlation coefficient among pulp and tissue prices.

9. The United States has a significant proportion of technologically advanced machines in tissue manufacturing, accounting for 90 percent of the global market for TAD, NTT, and other similar equipment. This is because higher-end tissue items that are delicate with absorbency are preferred and demanded by US customers.

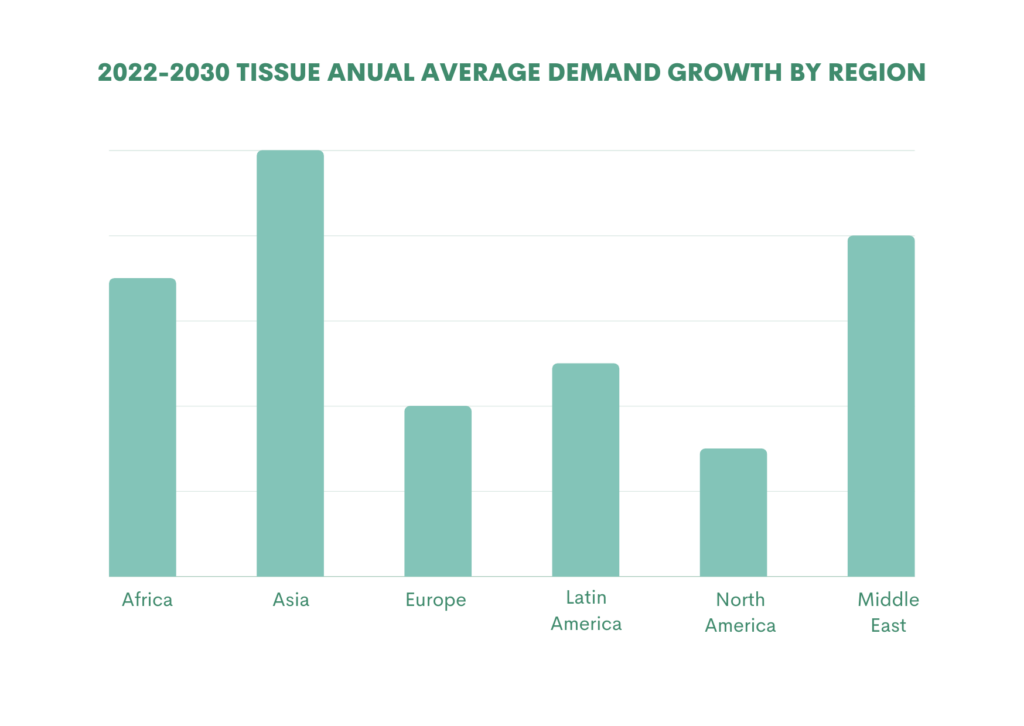

10. We anticipate a 1-5 percent increase in worldwide tissue demand over the next decade, with Asia seeing the largest growth.

We at The Coniferous are keeping a close eye on the developments of the towel and tissue paper industry. With plenty of turmoil plaguing the tissue industry owning to the disruption of production and supply chain, we aim to bring the best of paper products to our patrons. For more interesting facts and trivia about the tissue paper industry, stay tuned with Coniferous to know the latest and the greatest advances in the industry. And for all your paper needs, we at Coniferous are just a click away!