Exploring the Tissue Market Scenario in Thailand

The Coronavirus pandemic sent shockwaves throughout the world. The Thai tissue market was no different. Its competitive position in the region can only be reclaimed with a targeted investment cycle, innovation and modernization.

To understand the market dynamics of the tissue industry, it is important to understand the infrastructural, demographic, and economic dimensions. To say the current state of tissue production is inefficient would be a euphemism. Most tissue mills in the country were established in the wave of industrialization that followed the second World War. This underscores an urgent need to modernize Thai mills.

The collective impact of economic and demographic factors on tissue paper market

The disproportionate representation of elderly people in Thailand’s population is a result of nationwide population control programs launched in the 1970s. The long-term impact of these programs can be seen in the birth rate of Thailand this year – a mere 0.23% growth. This is due to a fertility rate of 1.5 – almost twice as low as the global average.

Thailand also boasts of well-developed infrastructure integrated into the global tissue paper market. This provides greater opportunities for the tissue economy to grow. Unfortunately, that’s not enough in the 21st century. Thai workers need regular skill training to compete with neighboring giants such as China and Indonesia.

Another important aspect is Thailand’s annual inflation. With a rate of less than 1%, Thailand is far below the global average. This implies a higher likelihood of strong consumer spending – another encouraging factor for the domestic tissue market. However, due to a recent surge, market expectations have lowered. The tissue market is expected to grow 6% by 2026 – significantly lower than last year’s forecasts.

The result of these factors collectively is a slow-growing domestic economy. This slow-growing factor is also reflected in the tissue industry. This is illustrated by the fact that only 7 new tissue producing machines were installed in the country in the last decade.

Despite slow growth, multiple active tissue manufacturers exist in Thailand. The most globally prominent among them is the US-based Kimberley-Clark.

Emerging Trends in the Thai tissue market

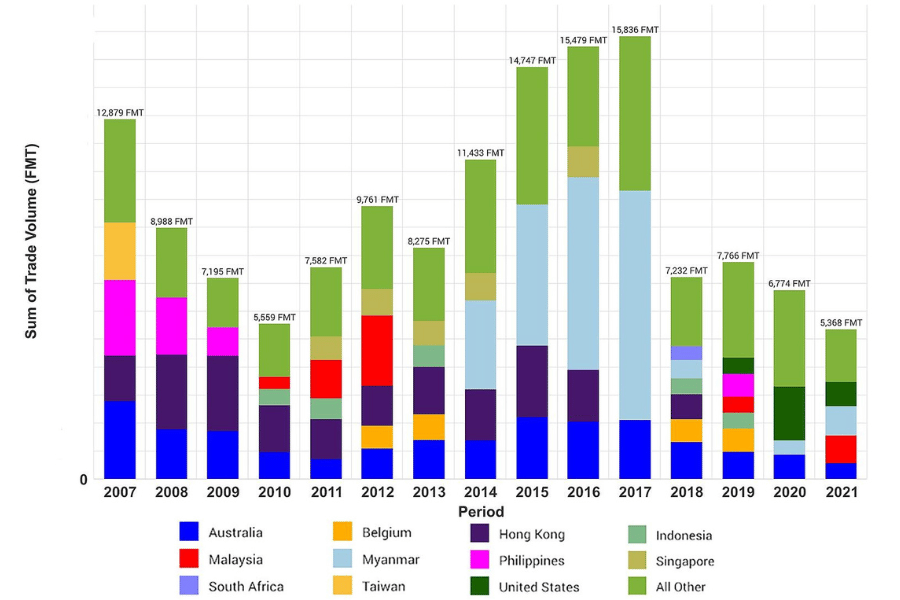

Import Trends

Thailand is an active player in the International tissue market and enjoys a small trade surplus. However, it still exports less tissue than it imports. Over the years, the trend shows consistent growth in tissue imports. This indicates that domestic production is struggling to meet domestic demand. It is also important to note that a relevant factor here is the pandemic as it played a key role in disrupting domestic production capacity.

Thailand Tissue Imports

Thailand Tissue Exports

Currently, Indonesia and China are the biggest exporters of tissue to Thailand. Whereas, the United States, Australia, Myanmar, and Malaysia are Thailand’s biggest tissue customers.

Unless domestic producers do something to expand production significantly, Indonesia will continue to have the biggest chunk of the pie. As of now, there are no plans to add new tissue machines anytime soon.

The complete absence of bamboo pulp tissue is also an interesting trend to study in Thailand’s tissue paper market. Tissue made out of Thai bamboo pulp is a niche product in the United States but lacks appeal in the domestic tissue marke

Housing Upgrades

A silver lining for the domestic tissue industry is impressive household growth.

This household growth has been followed by a deeper flush toilet penetration. According to a survey taken earlier this year, flush-toilet penetration stands at 90% and is expected to grow to 93% this decade. The continuing trend of an increase in the modernization of Thai households would serve as a foundational basis for long-term tissue growth.

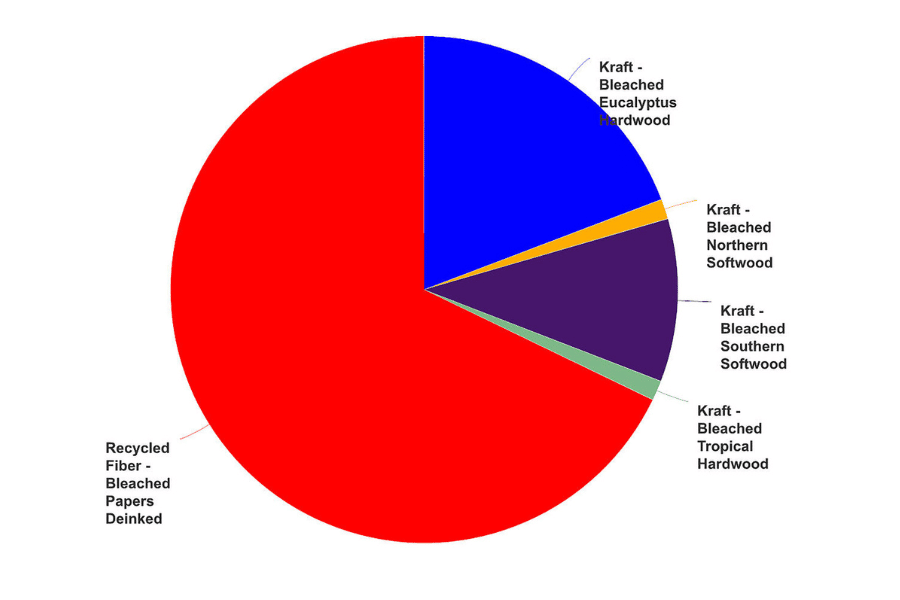

According to the latest Google Mobility Data, there has been a 7% increase in the total time spent. This is a direct consequence of the psychological impact of the pandemic. Another factor with a smaller economic impact but a massive environmental one is the use of recycled fiber. More than half of all tissue manufacturers in Thailand use recycled fiber. The most common pulp in use is bleached Eucalyptus pulp followed by bleached southern softwood kraft.

Thailand Tissue Fibre Sources

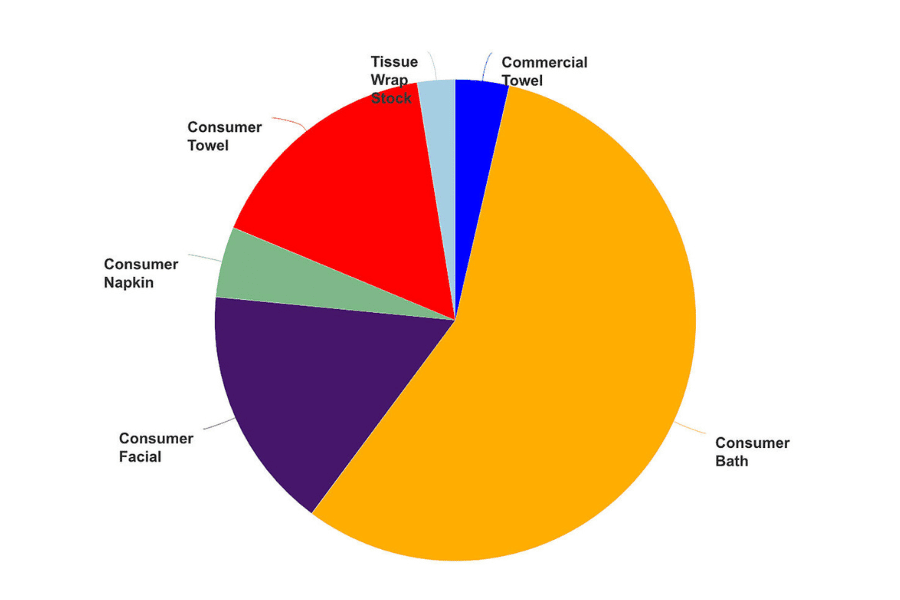

Away from Home (AfH) recovery

AfH sales form a big piece of the tissue sales pie. The resumption of tourism after the pandemic has much to offer and shows positive signs of recovery. 12% of Thailand’s GDP comes from tourism. As tourism revives, the demand for tissues by hotels and restaurants will shoot up. Thereby, bolstering the growth of tissue sales. This would also lead to a rise in sales of Special tissue grades such as tissue wrap stocks and commercial towels.

The need for modernization

An analysis of top tissue producers’ machine age and width shows that Thailand lags behind. The Philippines is the only producer that has narrower tissue machines and the general age of Thai machines is pretty old by relative standards. Despite this, in terms of mill viability – Thailand still ranks #2 in the world. Although, the gap between Indonesia and Thailand is quite high.

Thailand lags behind in terms of carbon emissions too. Its carbon footprint is a potential cause of concern. Indonesia, with its new mills, has done much better on this metric as well.

Conclusion

Irrespective of other factors, overall economic growth will always be the driving factor behind the growth of the Tissue Industry in Thailand. There exists a strong causal link between retail tissue sales and disposable income. As Thailand continues to prosper economically, Thai households will continue to modernize, and flush toilet penetration will eventually cross 95%. The primary challenge for Thai producers continues to be the competitive neighbors and domestic production capacity. This highlights the need for investments, innovation, and modernization of the sector.

Stay in tune with the latest trends and developments in the industry only with Coniferous. Coniferous is India’s leading provider of craft paper, tissues, and other organic paper solutions to consumers across the world. Stay curious, stay green, only with Coniferous.