3 Key Insights into the Pulp and Paper Industry

The pulp and paper industry is experiencing rapid growth, and new technologies and developments are continually sprouting across the industry. With a valuation of around 351.53 billion USD in 2021, the growth trajectory is set for around 354.39 billion USD and predicted to touch the 372.70 billion USD mark by the end of 2029. Such huge growth is helping the industry flourish with a CAGR of 0.72%. The pandemic also caused a major slowdown in the pulp and paper industry which disrupted supply chains and reduced demand. A steep decline of 0.1 percent in 2020, compared to 2019.

This forest-based industry, one of the largest of its kind has been focusing on procuring more sustainably sourced resources to make products ranging from bamboo, and wheat straw to rice husk. This switch of aim to a greener approach will play a vital socio-economic and sustainable role in the development of the products while keeping a keen eye out for the environment. Although, procurement challenges keep on haunting the sector owing to the digitization and the constant changing of the prices of raw materials and their availability.

This sustainable trend can be seen across all the major players of the FMCG industry with many of the big players adopting major sustainability goals that will ensure to have a positive impact on the growth and flourishing of the pulp and paper industry.

Covid 19 woes of pulp and paper industry

In the wake of the pandemic, the sector was greatly impacted as major supply chains shut down across the world. And with the increased demands for hygiene paper products for those at home, prices destabilized, and big brands struggled to meet both personal and commercial demands across the world. Other paper products like print paper and stationaries also saw a huge decline in demand as schools and offices opted for a home-based model to keep the pandemic at bay.

Trends in the pulp and paper industry

With the pandemic now seeming a distant worry for many, the world is now returning to a new normal. Also, the pandemic helped with an increasing number of internet and smart device adoption across developing nations like India, Brazil, China, and others. This meant a large portion of the population stayed home and preferred to work, study and shop online.

Recent projections from the Indian Brand Equity Foundation reported that the number of online shoppers is set to reach 220 million by 2025 in India. This also helped with the growing need for packaging and logistics. By introducing flexible, lightweight packaging by the big players of the pulp and paper industry in line with their vision of reducing plastics and responsibly sourcing materials, the demand for paper bags, corrugated boxes, and flexible packaging has seen a significant rise.

What drives the growth?

The world is now leaning toward an anti-plastic sentiment that is propelled by government legislation. India for example has banned the use of single-use plastics and brands are scrambling to find greener alternatives to serve customers and avoid being irrelevant. Owing to the rising concerns, brands are switching to more paper-based solutions as paper is among the most sustainable and recyclable packaging materials. This keen focus on paper packaging will help bolster the growth of the sector in the upcoming years.

What restrains the growth?

From wood sourcing issues to water crisis and continuous procurement of raw materials seems to be a key hindrance to the growth of the sector.

With the growth of other segments owing to the rise of e-commerce and the adoption of paper-based packaging solutions, the wrapping and packaging segment is expected to see the highest growth in the coming years. As eCommerce and online shopping becomes more of a staple in our lives, the demand for wrapping and packaging materials will see exponential growth in demand.

Also, the sanitary segment is expected to exhibit growth as people now have more disposable income than ever, and the pandemic teaches us the value of sanitation and hygiene. The print segment is expected to lose ground thanks to an increased emphasis on digitization.

Regional Insights

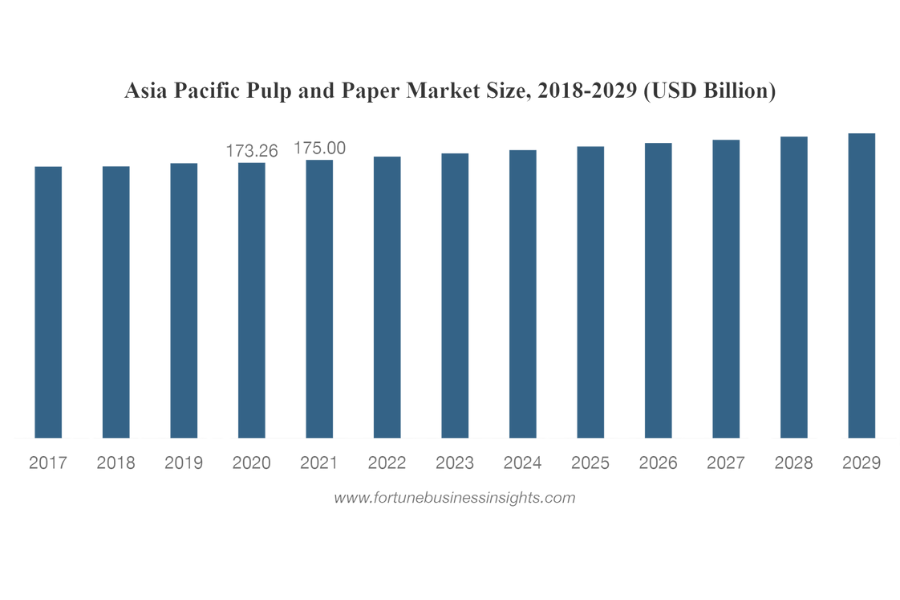

2021 saw the Asia Pacific region among the biggest contenders in the market and is expected to lead the global market with market size of 175 billion USD in 2021 with China being the leader of the herd. India too has seen a major spike in demand for paper-based products and is expected to share a positive growth trajectory along with other South Asian nations.

On the other side of the globe, North America and Europe already have a matured sector and are expected to have a slow but steady CAGR. Europe is the second largest consumer of paper and will hold its share in the market to meet its sustainability goals. However, the print segments are expected to fall due to the larger adoption of digital media across the world.

South America is expected to show a positive trend going forward with Mexico being the top contender to grab the market share. Although the per capita paper consumption is on the lower side when compared to the northern and European counterparts, the segment will most likely experience rapid growth in the coming decade.

Stay in touch with the latest trends and innovations of the pulp and paper industry with Coniferous. We, at Coniferous Multitrade are committed to bringing you the best the industry has to offer so that you too can play your sustainability role for a better earth.