Understanding the Impact of Lumber and Wood Price Index Dives on the Economy

The current state of the lumber and wood industry has been a hot topic recently, with many experts weighing in on the reasons behind the dramatic fall in the softwood price index. One industry that has been greatly impacted by this downturn is the paper and pulp industry.

The lumber and wood price index saw a 26% fall in softwood prices in just one month, sending shockwaves through the industry. This drop in prices has been attributed to a number of factors, including a decrease in demand due to the COVID-19 pandemic and a surge in supply as lumber mills increase production to meet demand.

Declines in both consumer and producer price indices

The consumer price index (CPI) and the producer price index (PPI) have both declined, adding to concerns about the economy’s state. The decrease in the final-demand index can be attributed to a decline in prices for goods, led by a drop in wholesale prices for gasoline. In contrast, the index for final demand services rose, driven by a jump in margins for fuels and lubricants retailing.

Forest products sector insights

Pulp, paper, and wood fiber prices have increased, with the price index rising by 0.4% (+9.2% YoY) and wood fiber also seeing a modest increase. However, lumber and wood products decreased by -1.5% and -26.1% YoY for softwood lumber. These drops reflect manufacturing hesitancy in new home starts due to rising interest rates to combat inflation. Monetary restraint is having an effect on demand in the most interest-sensitive sectors of the economy, particularly housing.

Impact of interest rates

Interest rates continue to rise to combat inflation, causing a significant impact on the economy. The Federal Reserve Open Market Committee (FOMC) recently announced a 0.25PP rate hike. The effects of these policy actions on demand are most visible in the most interest-sensitive sectors of the economy, particularly housing. However, it will take time for the full effects of monetary restraint to be realized, especially on inflation.

Continued manufacturing contraction

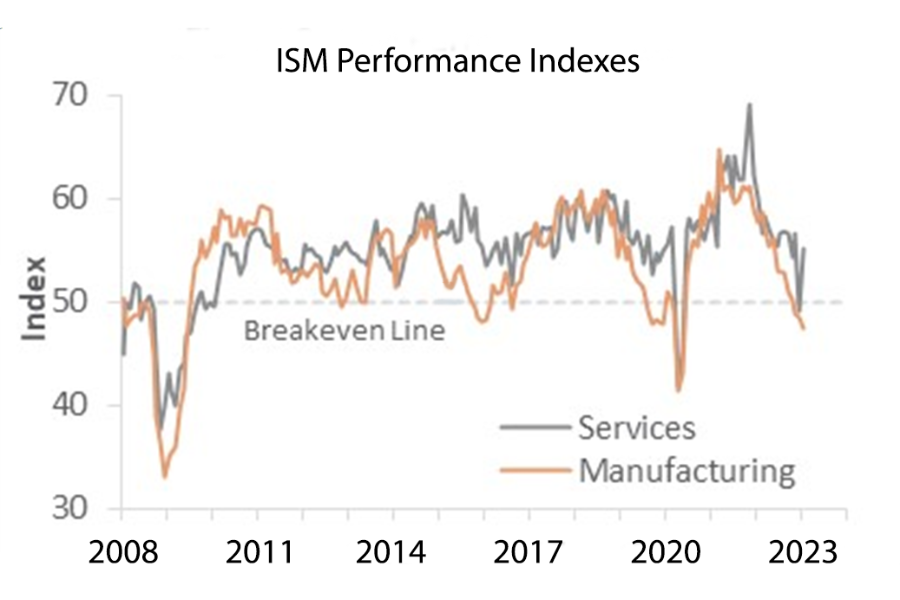

The monthly sentiment survey conducted by the Institute for Supply Management (ISM) for U.S. manufacturers in January 2023 showed a continued contraction in the manufacturing sector. The PMI decreased to 47.4%, a decline of 1.0PP from December, with the breakpoint between contraction and expansion being 50%. The report also highlighted significant changes in several areas, including prices paid, exports, imports, and new orders. However, there was a positive note in the concurrent activity of the services sector, which bounced back into expansion with a 6.0PP increase to 55.2%. This rebound was driven by new orders and exports, surpassing all previous month-over-month (MoM) moves before the pandemic. It is worth noting that only the Real Estate and Ag & Forestry industries showed expansion among the industries tracked.

Source: Fisheri.com

Overview

First, let’s talk numbers. The lumber and wood price index is a weighted average of the price changes in wood products. This particular index focuses on softwood lumber, which is a vital component of the pulp and paper industry.

So, why the drastic drop? One reason is the impact of the COVID-19 pandemic on the industry. During the initial wave of the pandemic, many mills were shuttered or scaled back production, causing a decrease in demand for wood products. Additionally, the trade war with China has caused a decrease in demand for American wood products, particularly softwood lumber.

But what does this mean for the pulp and paper industry? Well, the pulp and paper industry relies heavily on softwood lumber, using it to produce paper, packaging, and other wood products. A decrease in the price of softwood lumber could lead to a decrease in the cost of production for the industry, which could ultimately lead to lower prices for consumers.

However, it’s not all good news for the pulp and paper industry. A decrease in the price of softwood lumber could also lead to a decrease in the value of timberland, which could impact the industry’s ability to source wood products at a reasonable price. Additionally, a decrease in the price of softwood lumber may be indicative of an oversupply of wood products in the market, which could eventually lead to a decrease in demand.

So, what can we expect from the pulp and paper industry in the wake of this news? It’s hard to say for sure, but it’s likely that the industry will continue to adapt and adjust to changes in the market.

In conclusion, the lumber and wood price index may have taken a dive, but the impact on the pulp and paper industry remains to be seen. While a decrease in the price of softwood lumber may ultimately lead to lower prices for consumers, it could also have a negative impact on the industry’s ability to source wood products at a reasonable price. One thing is certain, however: the industry will continue to evolve and adapt to changes in the market, ensuring that it remains a vital component of our economy for years to come. Stay tuned with Coniferous to stay at pace with the latest updates about the P&P industry.